+

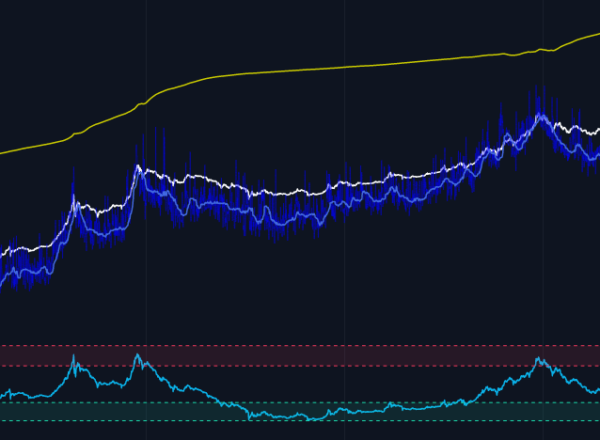

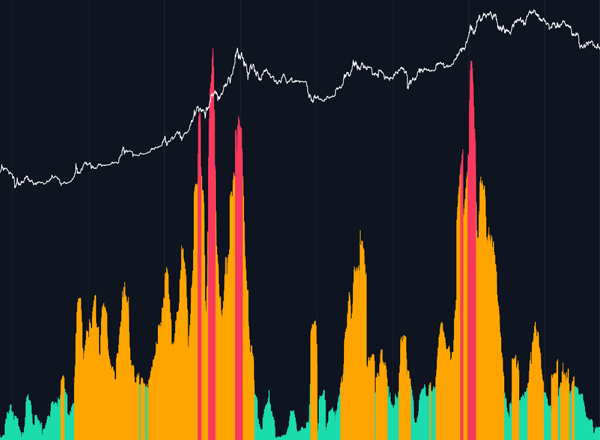

Bitcoin Investor Tool: 2-Year MA Multiplier

Simple-to-use long term $BTC investment tool for Bitcoin over macro timeframes.

+

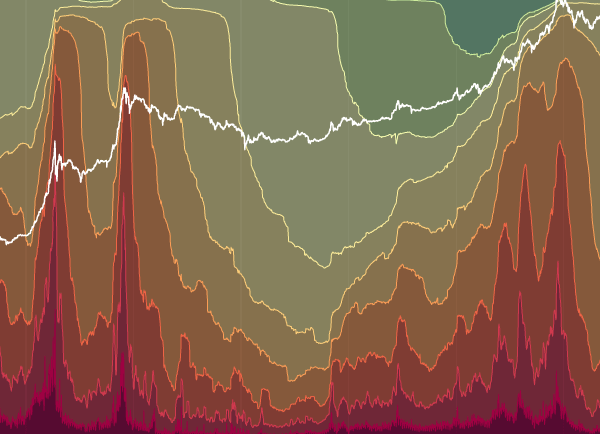

200 Week Moving Average Heatmap

A colour coded heatmap that looks at the % increases of the 200 week moving average over time.

+

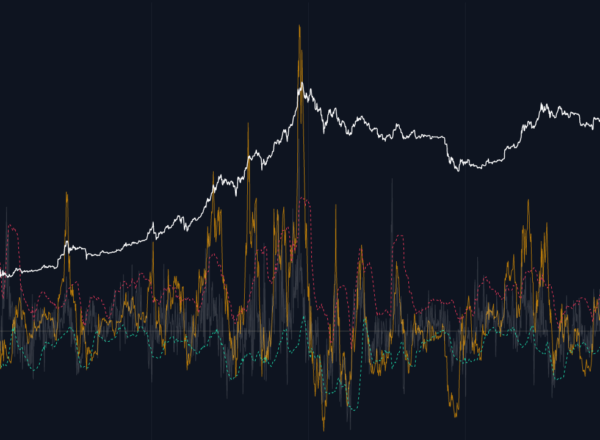

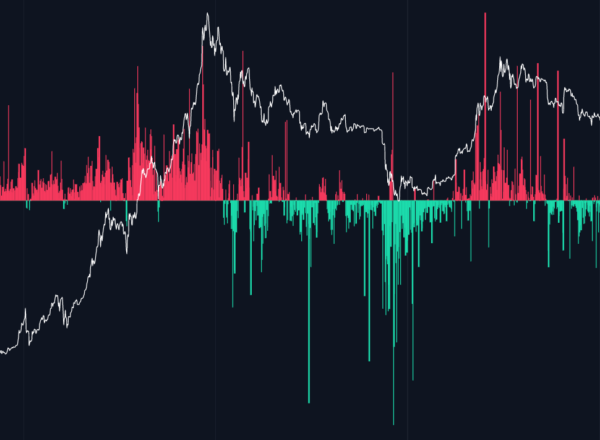

The Puell Multiple

Puell Multiple is a valuation tool for $BTC looking at Bitcoin miner revenue over time using a 1yr moving average.

+

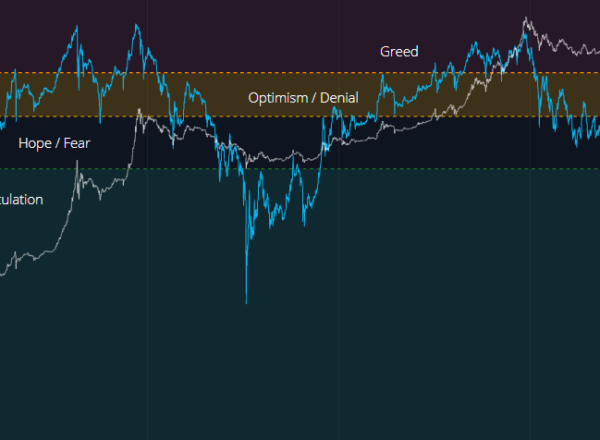

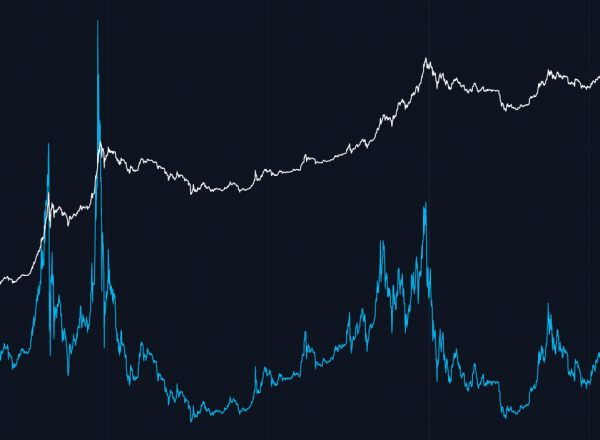

Pi Cycle Top Indicator

Pi Cycle top is a free live data chart for Bitcoin. This indicator has picked the top of previous $BTC market cycles to within 3 days.

+

Golden Ratio Multiplier

The Golden Ratio Multiplier live chart explores Bitcoin's adoption curve and market cycles to understand $BTC price behaviour.

+

Bitcoin Profitable Days

Free live data chart showing number of days in Bitcoin's traded history where holding Bitcoin has been profitable relative to today's price.

+

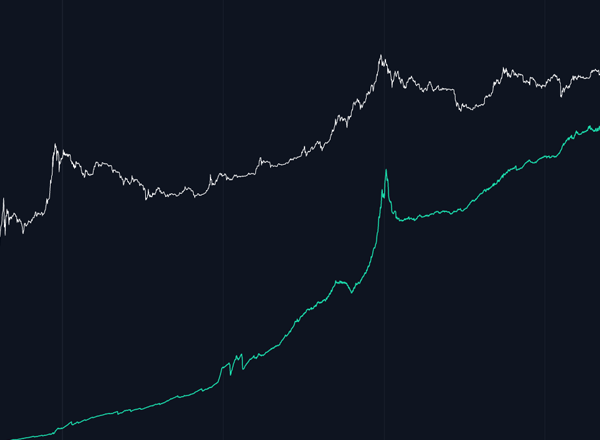

Bull Market Comparison

This chart looks at each of the 3 major Bitcoin cycles since their relative halving dates. Each line starts at the halving date and the x-axis runs on from that point in number of days.