5 things you need to know about Bitcoin right now

The market finally showed its hand last week with a sharp move down for Bitcoin (-12.4%) in a day, and the rest of crypto also experiencing major pullbacks.

So what is going on? These are the 5 things you need to know about the price move down, what it means for the potential bull market, and what might happen next.

#1. The move down was a derivatives-led reset

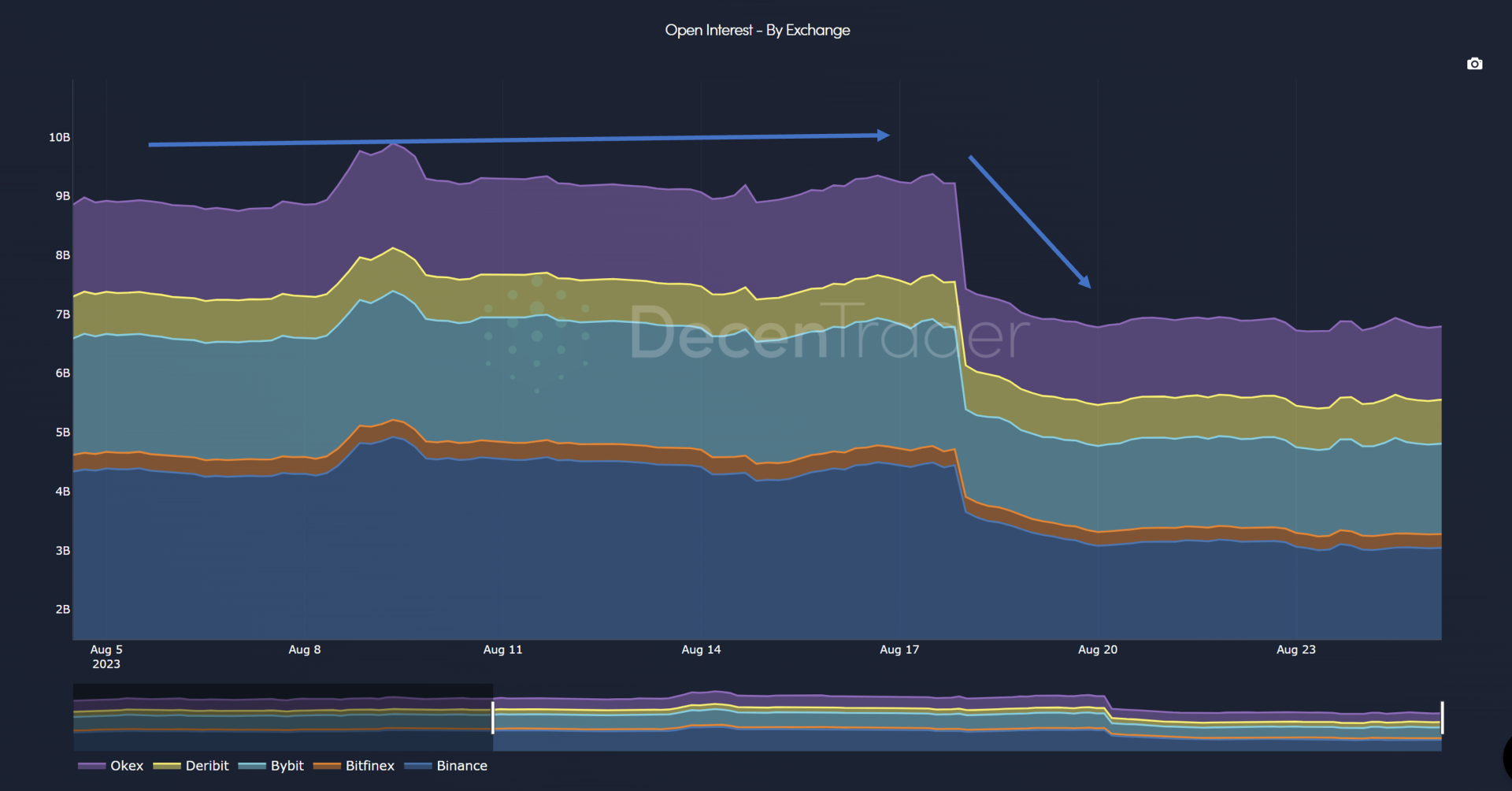

For the past two months Bitcoin had been trending sideways with little volatility. The big move finally arrived last Thursday, and it was to the downside. It caught a lot of derivatives traders offguard, wiping out open interest across major exchanges as many traders who were positioned long anticipating upside got liquidated.

Open Interest drop across exchanges as price crashed.

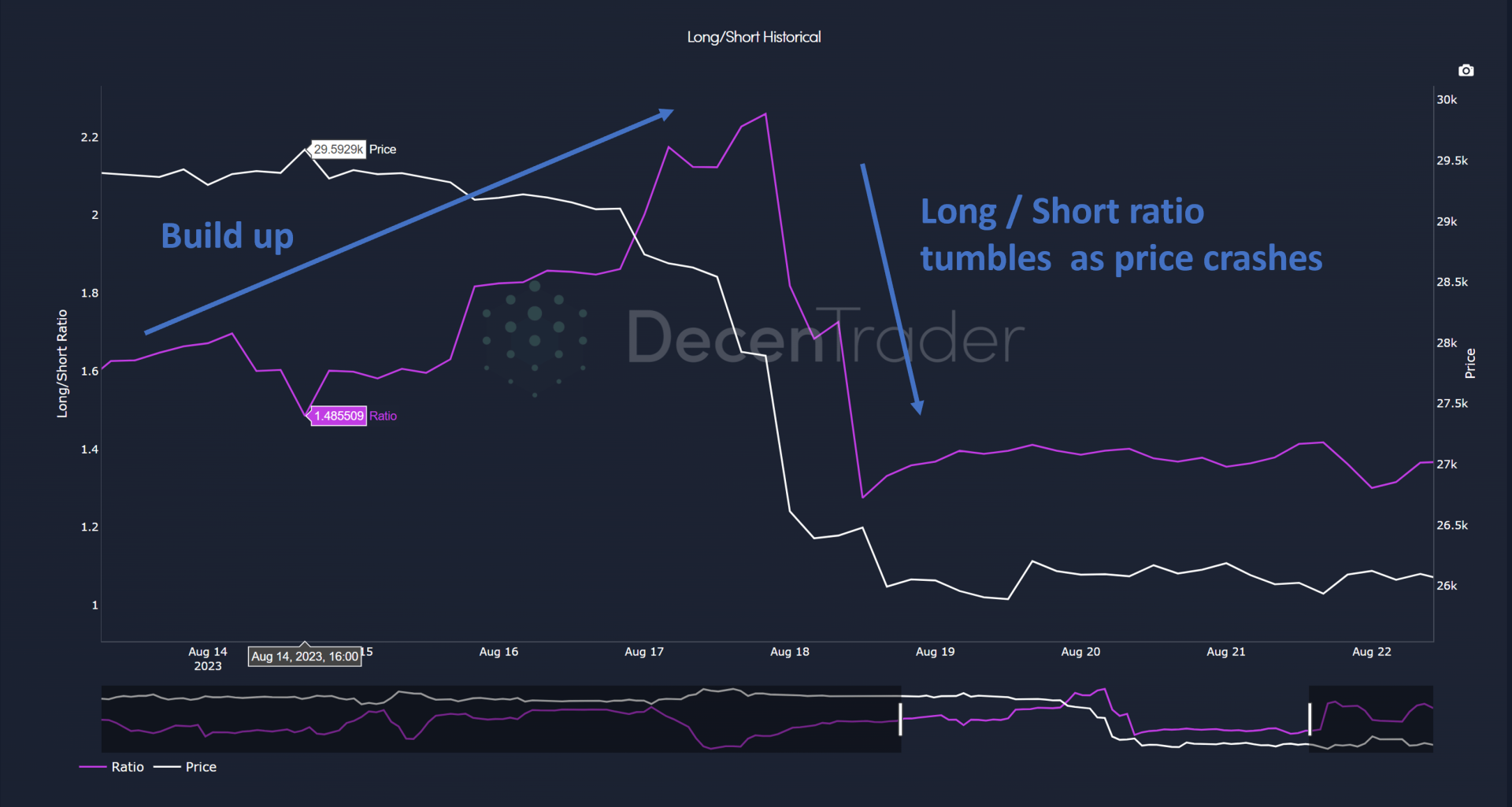

In total nearly $2bn of open interest was wiped out. This move in price also caused a reset of the Long / Short ratio which had been heavily long before the move.

Bitcoin Long / Short ratio

And it also sent funding rates down from being heavily positive for a consistent period of time before the move, to flipping negative. Indicating that many traders were shorting or hedging after the move in case of further downside.

Average weighted funding rates switched from positive to negative.

#2. The current near term trend is bearish until proven otherwise

The move down came as a shock for many traders as highlighted by the data mentioned above. However, the overall trend has not been bullish the past couple of months as Bitcoin has struggled to successfully conquer $30,000.

Predator has highlighted the bearish risk during this time.

Predator weekly timeframe.

Until Predator begins to turn green on 1D, 3D, 1W timeframes the broader trend remains at best one of consolidation and chop, at worst bearish.

At the time of writing Predator remains choppy on low timeframes as price consolidates and is bearish on higher timeframes.

Predator Thermal Vision showing cross-timeframes.

#3. The support and resistance levels to watch

For now Bitcoin is consolidating in a tight range between $25,772 and $26,808 after the sharp move down. Unless some major news hits the market it likely needs more time to consolidate.

Should it break out to the upside the first notable resistance sits at $27,887.

#4. Are we still even in a bull market?

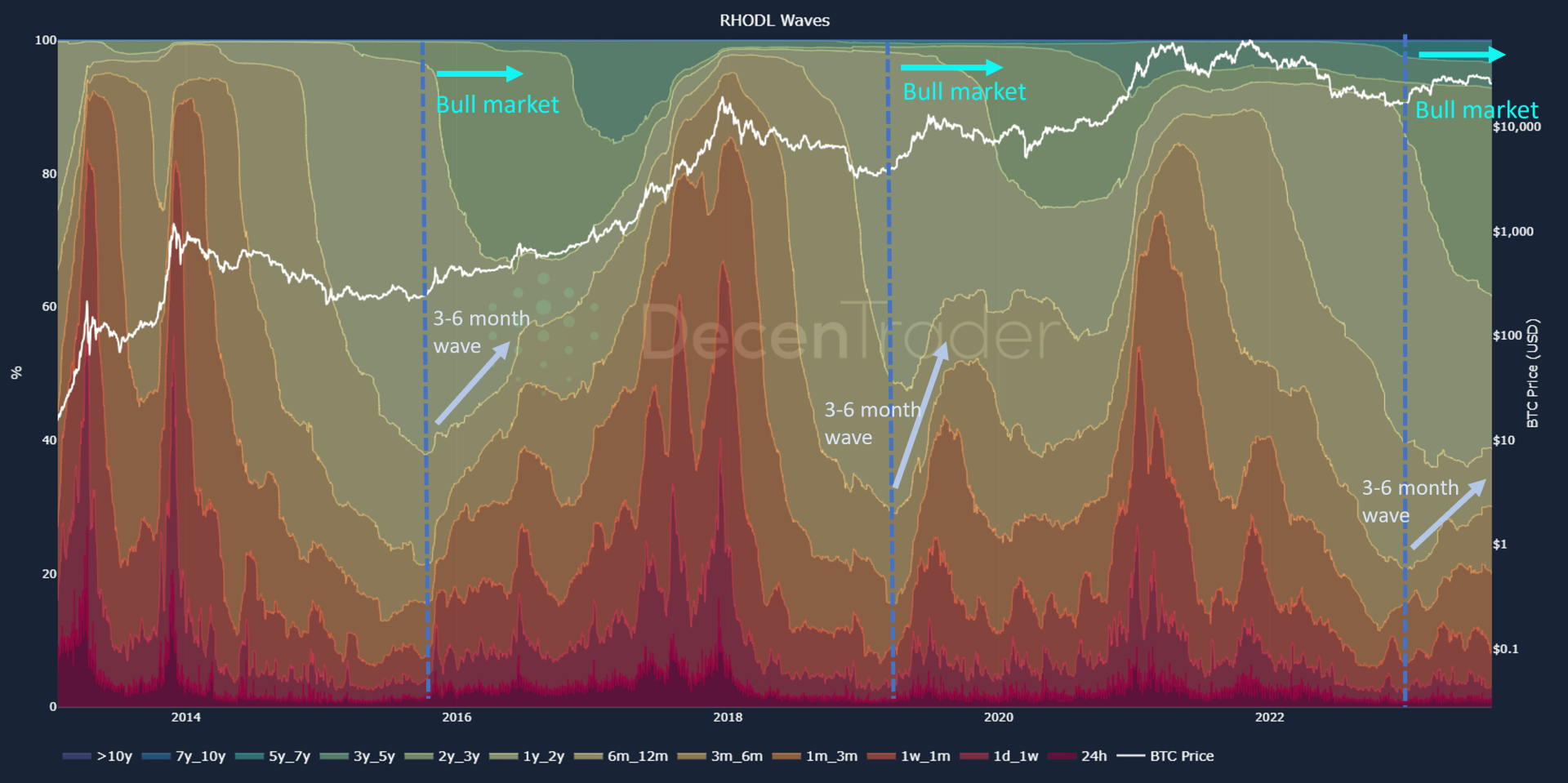

In our opinion, yes. On-chain data has fundamentally evolved in recent months in a way that is very typical of early bull market phases. Realized Cap HODL Waves shows the economic weight stored by bitcoins of various holding periods. Increases in percentage share of younger coins (warmer colours on the chart) happen in late stage bull markets as new money floods in increasing the value of those younger bands.

In early bull markets the 3-6 month bands turn around, and begin to increase after having decreased throughout the bear market. We saw this occur again back in Dec 2022 at what now appears to be the bear market lows after the FTX crash.

Realized Cap HODL Waves.

This indicates that money flows on-chain are broadly consistent with what has happened in previous early bull market phases.

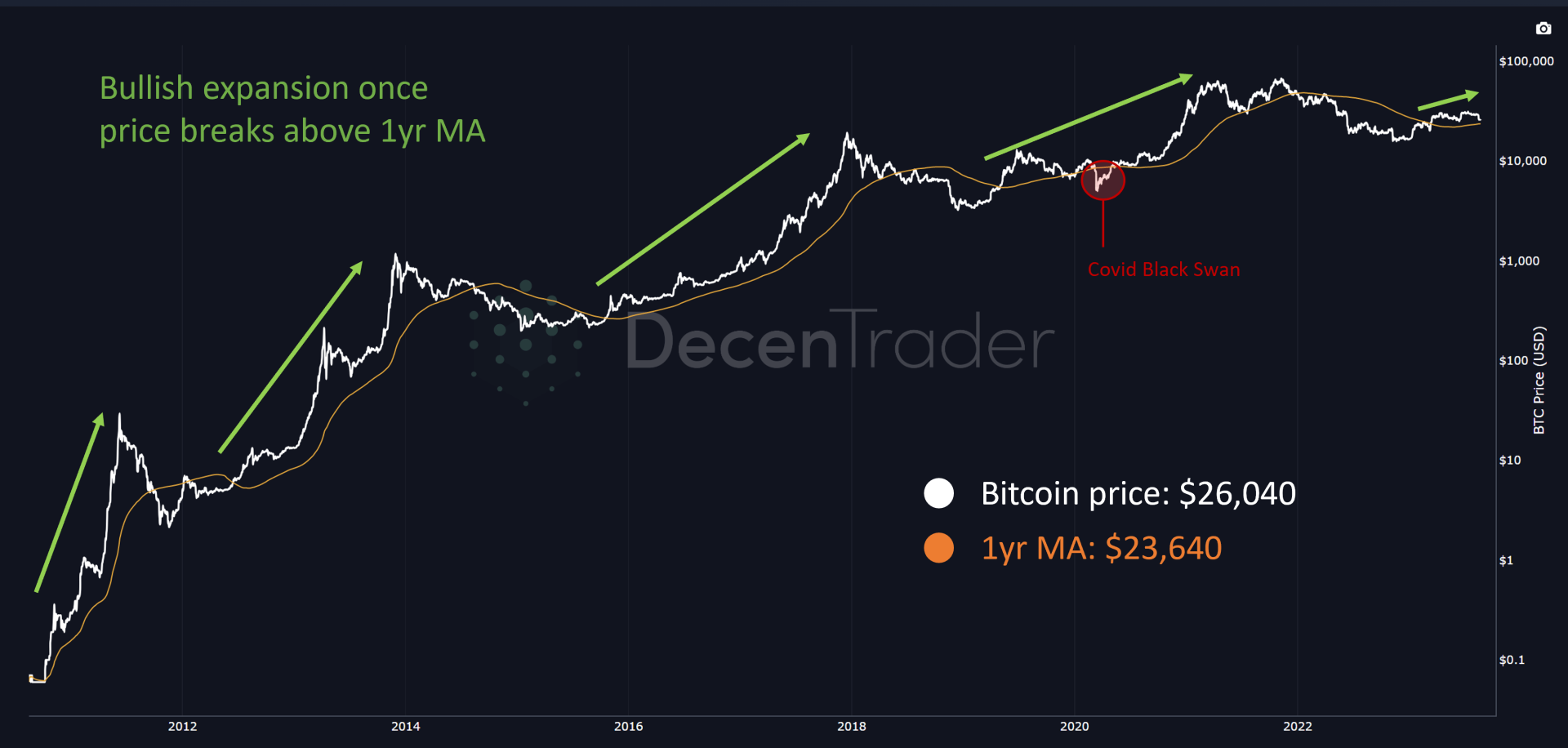

Using a much more simple tool of Bitcoin’s 1 year moving average, it also suggests that Bitcoin remains in a bull market. Throughout Bitcoin’s history it has had bullish expansion into a new bull cycle after price has broken above the 1yr MA.

Bitcoin price and its 1yr MA.

For now $BTC price remains comfortably above the 1yr moving average of $23,640.

#5. When will the market start really trending up?

Unless there is a major good news event such as an approved Bitcoin ETF in the US, it is likely that more time is needed to consolidate in this early bull market phase. New retail money is unlikely to return at scale until price meaningfully breaks through the $30,000 level which is the price level where Luna/3AC blew up in Q2 2022. Breaking through that level will indicate that the market is ready to move on from what was a major blow to the credibility of the entire industry.

As time passes though we move closer to the Bitcoin Halving, now just 234 days away. We expect it to start getting more media attention in Q4 this year.

Bitcoin’s halving cycles.

The prior two cycles show that while the general trend leading up the halving is one of accumulation, we should be prepared for extreme volatility in the run up to Bitcoin’s halving next year…in both directions.

The DecenTrader Team.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.