Bitcoin reset before any major move higher

It has been a stellar year for Bitcoin (+150%). After a strong run up to $44,000 Bitcoin is now struggling to break through some key resistance levels and is rolling over on some key indicators.

Bitcoin unable to break through Sniper resistance

At the start of the month Bitcoin rallied up to Sniper resistance at $44,000, it tapped it and has since been unable to break through it.

Figure 1: DecenTrader Sniper tool successfully highlighting this area of resistance.

Price is now ranging below that key level with the next major Sniper support level down at $38,250.

If Bitcoin price can eventually break through the $44,000 level then $46,700 and $47,890 are the next levels up to watch in this bull run.

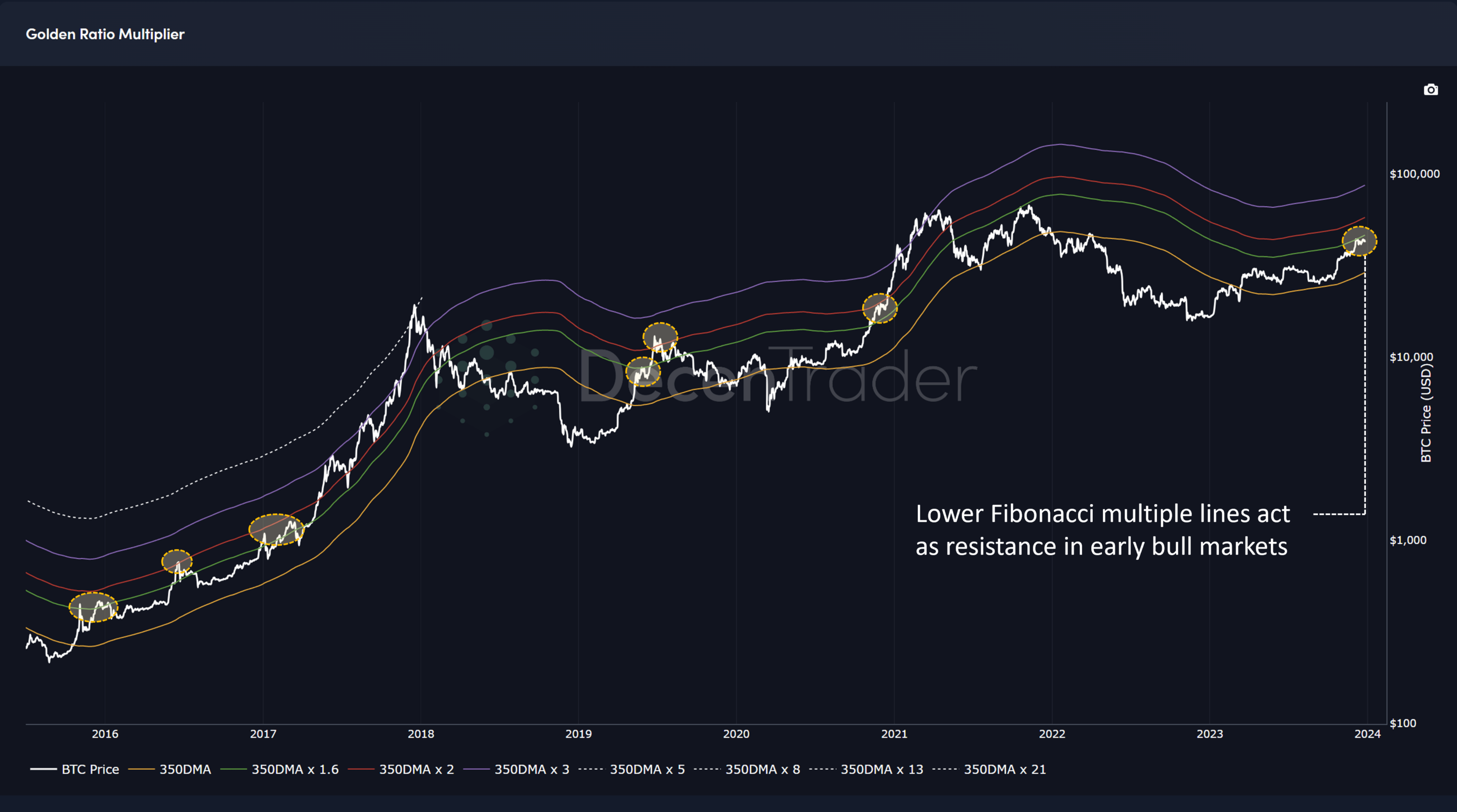

Bitcoin unable to break through Golden Ratio Multiplier resistance

The $44,000 level was also resistance according to the Golden Ratio Multiplier. This tool has successfully identified previous cycle tops for Bitcoin. However, in early bull market phases it can also identify local tops.

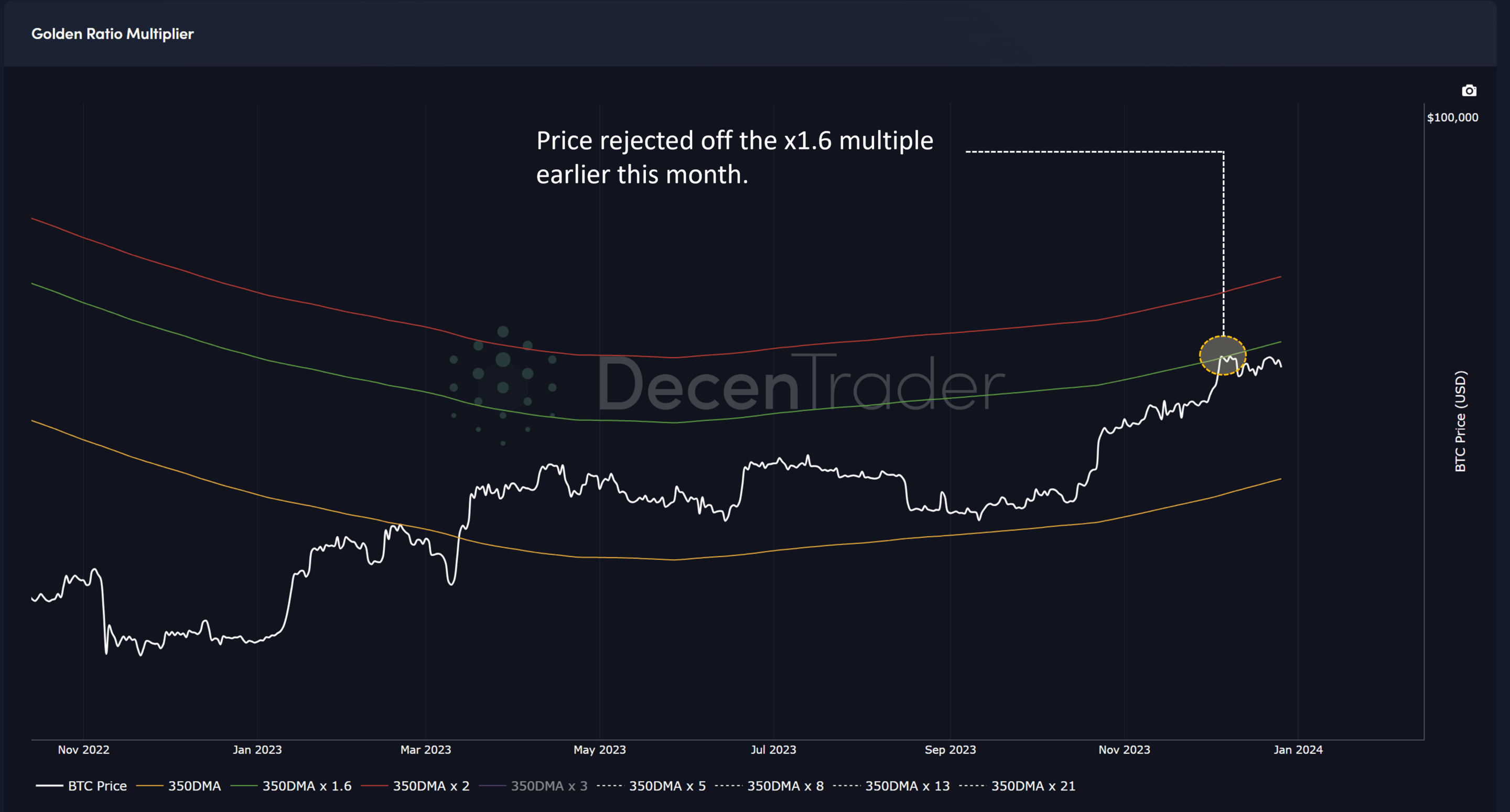

When price accelerates up to a Fibonacci multiple level it can indicate the market is overheated. This is exactly what we have seen when Bitcoin price came up to the Golden Ratio Multiplier x1.6 level (green line) in the last couple of weeks. Price reached it and was then rejected off it.

Figure 2: Golden Ratio Multiplier.

Here is a zoomed in view of the recent rejection…

Figure 3: Golden Ratio Multiplier – zoomed in view.

Funding rates are very high

As well as these clear rejections from key resistance levels, funding rates are currently climbing to very high levels. The highest we have seen in well over 2 years. Which suggests that many traders are betting that Bitcoin will continue to trend higher in the short term.

When market expectation is this overly optimisitic it often ends badly with some kind of correction in the short term until funding rates return to more typical levels and then the bull run can continue.

Figure 4: Bitcoin Funding Rates.

Funding rates are currently at 0.045 which is historically a very high level as traders look to bet on further upside for Bitcoin.

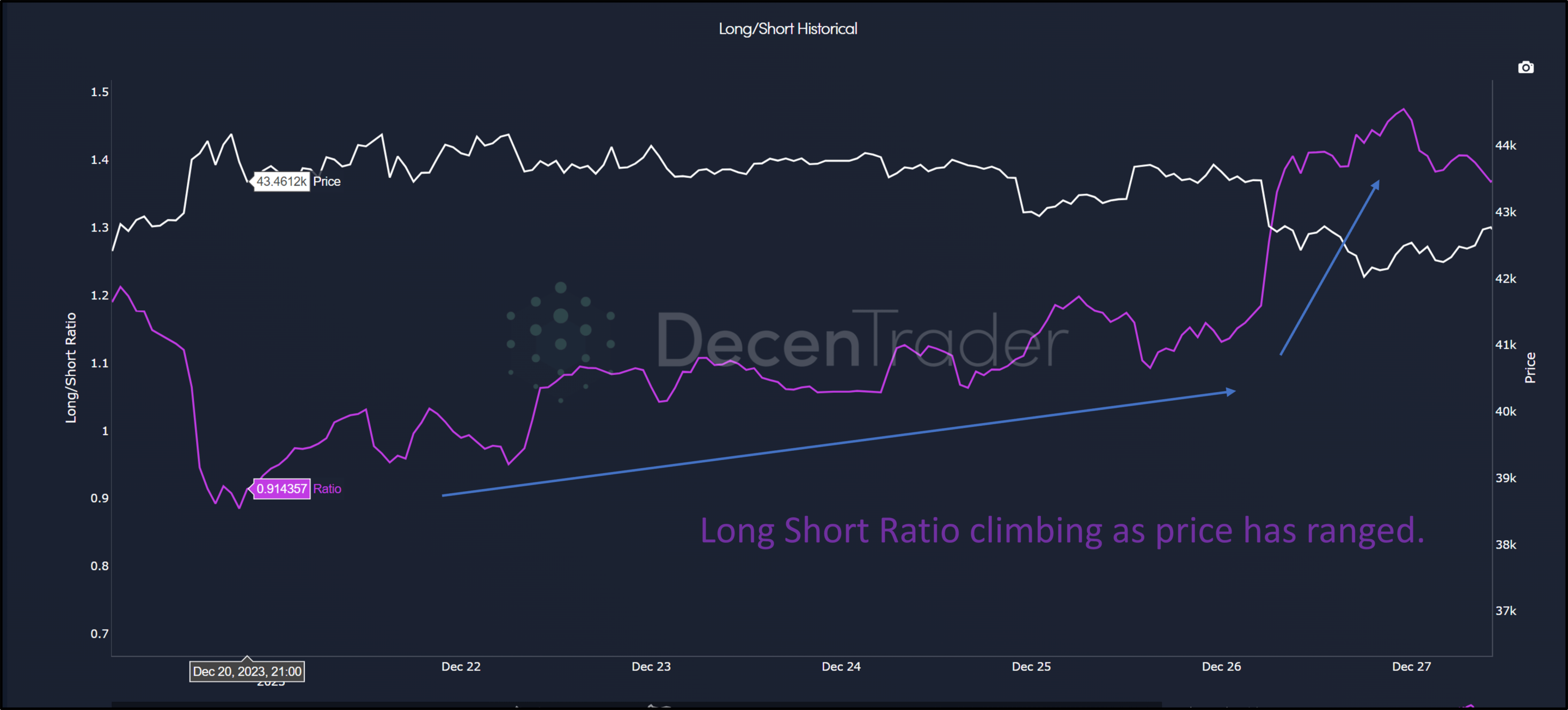

The ratio of longs to shorts is also high and climbing. Again, a sign that many traders are betting on further upside in the short term even though we have noted that price has been rejected from significant resistance levels around $44,000.

Figure 5: Number of Longs relative to Shorts has continued to rise.

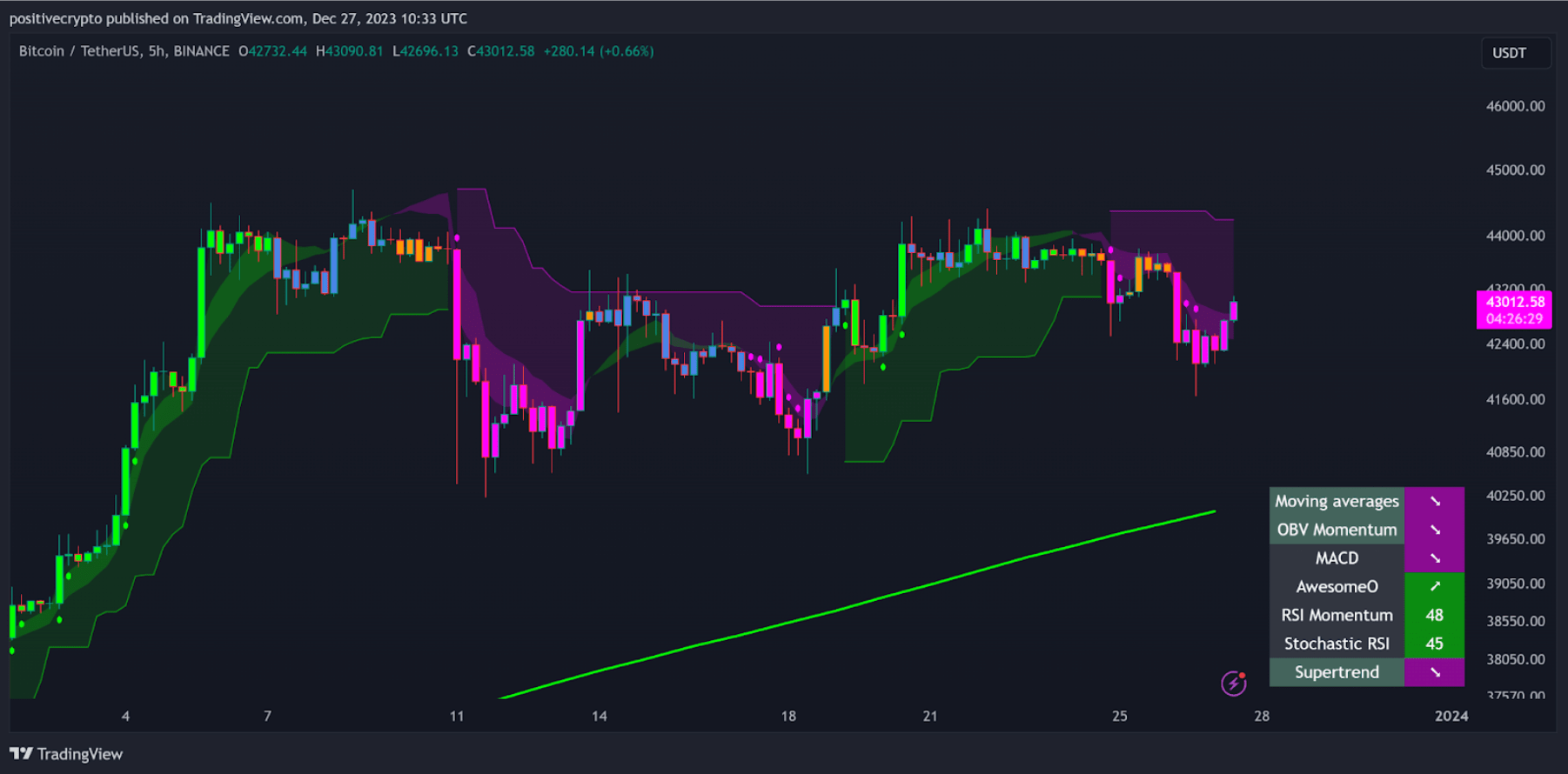

Ironman remains Bearish for now

The new DecenTrader tool, Ironman, is partcularly effective for Bitcoin on the 5hr timeframe.

Currently it is signalling bearish across OBV momentum, key moving averages, MACD, and Supertrend.

Figure 6: Ironman is bearish for Bitcoin on 5hr timeframe.

For any convincing attempt to make fresh highs we would expect Ironman to first turn bullish across these metrics.

Still a long way to go

MVRV Z-Score shows that there is still a significant amount of potential upside to come in this bull market. Based on previous cycles we are not anywhere near major cycle highs, with a current MVRV Z-Score of just 1.5.

So there is definitely reason for optimism on high time frames as we head into 2024, but based on short term market activity it may take some time before Bitcoin is pushing up towards new all-time-highs.

Conclusion

After a fantastic run in Q4 2023 Bitcoin price action has now slowed down. We believe this is due to it reaching key resistance levels. There is evidence that traders who may have missed the bulk of the move up are now arriving late and trying to long Bitcoin while its price up at major resistance.

We will likely need to see this exuberance from traders be flushed out and see key indicators like Ironman turn bullish again before Bitcoin can take it’s next major leg up in this bull run.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.