Bitcoin – Setting the scene for 2024

The following outlines a possible outlook for Bitcoin over 2024. It is mostly technical based and does not discuss Macro or Geopolitical events which could impact outlook and are omitted for the purpose of this discussion. This is not investment advice, but it is an opinion. Please do your own research.

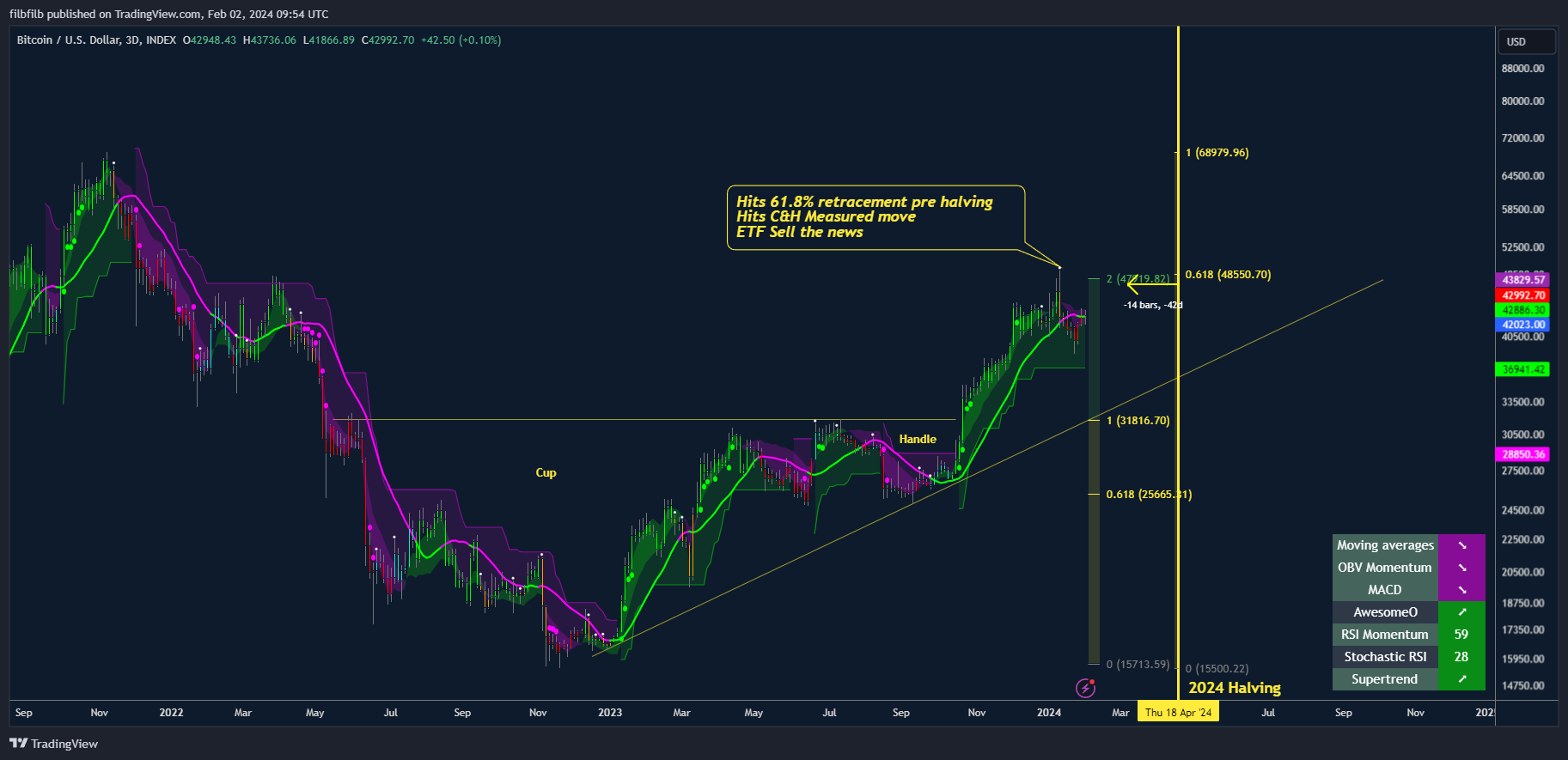

Bitcoin hit highs of $49k; the highest since March 2022, assisted by the hype around the ETF launch on January 11th 2024. This presented several reasons to sell Bitcoin:

- 61.8% Bear market retracement (happened prior to each of the previous halvings)

- Technical target from the Cup and Handle bottom

- Sell the news event

Bitcoin proceeded to pull back, aided by a supply dynamic unveiled by the ETF outflows from GBTC, with FTX liquidation of almost 20k BTC being thrown into the mix. Yet, following the dump of c.20% to $38.5k Bitcoin appears to have stabilized alongside the ETF flows.

With around 75 days before the next halving, we will examine how the market is poised and what could occur over the next few months.

BTC USD 3 Day chart with Predator Overlay – https://www.tradingview.com/x/5ihKtWg9/

Longer view:

Bitcoin Halving

Circa 75 days remain until the Bitcoin halving, with it due to occur around the 18th April 2024. This is important if we make a simple assumption, that there will be buying interest some time before the halving. I would expect this to be no later than 6 weeks before the halving – or around the second week of March. This would mean that Bitcoin has around 30 days from now to meander through its corrective phase before finding the FOMO demand anticipated. To some extent this curtails the expected downside risk somewhat – we will examine this in more detail with the short term outlook, as by definition.

BTCUSD 3 day chart – https://www.tradingview.com/x/DQTmnkA0/

To some extent, the close proximity of the halving is capping the downside on BTC in my opinion, for now. So in terms of forecast, it seems reasonable to expect some continued choppy consolidation until early March, before some additional fomo towards the $49k level followed by a sell-the-news event again. Bitcoin has a tendency to front run the sell-the-news with a halving so bear that in mind.

Following the Halving, Bitcoin has taken 220 – 240 days to break to new all time highs. I am expecting a similar outlook, with Bitcoin taking a trip to new all time highs in mid to late Q4 of 2024, which give some time for a correction to test investor’s revsolve inbetween.

Therefore we’ve derived some basic assumptions

- Consolidation to early March

- Fomo window in March

- Correction in April

- Long period of consolidation with room for some major bumps in the road.

- Q4 All time highs.

What has become apparent is that a lot of people are convincing themselves that Bitcoin is going to run to new all time highs ahead of the Halving because “it’s different this time”. I personally expect it to be no different to previous instances; there is an uncannily accurate market cycle schematic for Bitcoin born out of the emotions of investors into an asset class to which many are emotionally attached – it seems unwise to expect this to break (favorably) now.

https://www.decentrader.com/charts/bull-market-comparison/

Shorter term outlook:

At present, Bitcoin is fighting with the 50 DMA which has proven to be a pivot point through 2023 in particular. This is while also being trapped below the trendline dating back to October 2023. This has the hallmarks of being a complacency shoulder which would suggest a correction towards the bottom of the 3 day supertrend, or around $37k; although tight, this seems possible to occur within the next 4-5 weeks, or within the choppy / consolidation window mentioned and conveniently sits with the theoretical timeline and is therefore my preferred view.

https://www.tradingview.com/x/JfOgkKQU/

The second possibility is that Bitcoin has indeed recaptured the momentum required to push again for the $49k highs. We have seen ETF flows return to being positive over the last week and at the same time Bitcoin has put in an inverted Head and shoulders which would present an upside target of $48.8k.

https://www.tradingview.com/x/ia270IgM/

As it currently stands, it is unclear as to which path will be taken, while at resistance and flirting with the 50 DMA, it seems reasonable to be cautious as a push higher may be viewed as being a little ahead of schedule.

Market positioning:

To get a deeper look at how the market is setting up, we can review the positioning of the market reviewing the decentrader dashboard;

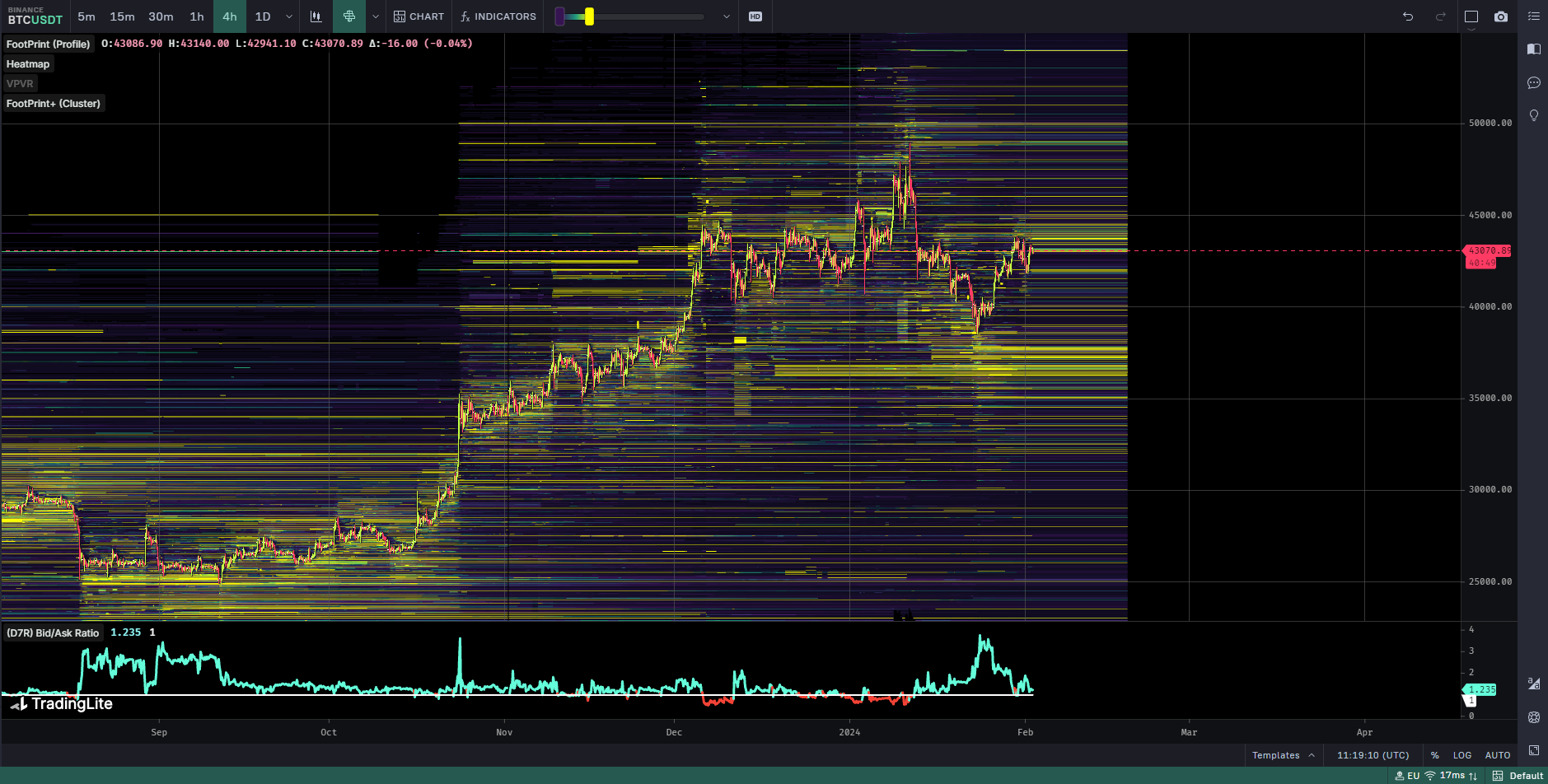

Here we can see over the last 3 days, the market has remained relatively flat, with open interest slightly declining, the number of accounts long relative to those short, being at 1.2 and funding increasing slightly, but remaining low.

This implies that there is not a gargantuan fomo occurring here at resistance and there are no particular extremities to note, which again helps with the notion that if we correct it may not be as deep as people think, but also its not implying a major breakout is coming.

The sign of a breakout would be price pressing higher, with the positioning of the market showing more bearish intent (LS ratio dropping, OI increasing, funding dropping) This can change quickly and should be monitored accordingly, particularly as the market chooses a direction.

Source: Decentrader Dashboard

Orderbook

Bitcoin’s orderbook (showing Binance) demonstrates that the bulls are willing to show buying interest $35.5 – 38.5k, fitting with the corrective idea and there being a floor somewhere around $37k.

Note that the ratio of Bids-Asks within 15% of price hit 3.5 on the decline to $38.5k, which is certainly notable as a place for a bottom as we saw back at the lows in August of 2023.

Source: Tradinglite Binance USDT Orderbook

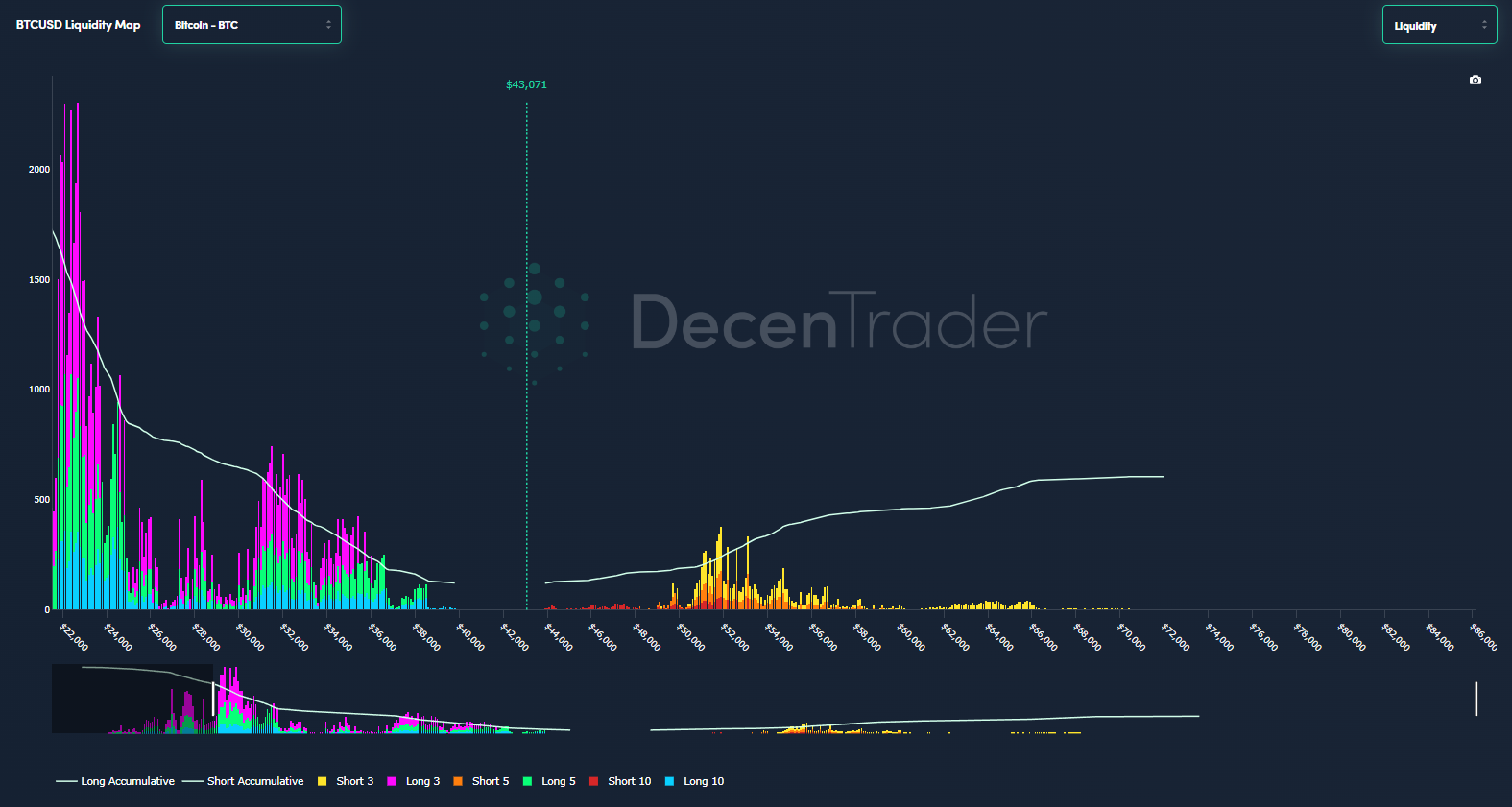

Liquidity

Theoretically, should $37k fail to hold up, there is a crescendo of liquidity towards $30k, which would imply testing the breakout from the Cup & Handle. As mentioned, I see it as being a little unlikely that this is tested prior to the Halving, but it remains in the scope of possibilities. This zone would see 3x liquidations come into effect, which is usually the straw that breaks the camel’s back when it comes to big wipeouts due to increased position sizing and conviction being eliminated.

Source: Decentrader Bitcoin Liquidity Map – https://www.decentrader.com/liquidity-maps/?coin=btc

Summary

A general roadmap summarized would imply a strong base through to April around $37 and a range to $49k, with the remainder of the year being a meandering sideways, with a broad possibility of briefly testing $30k at some stage and new all time highs in Q4 2024. Bitcoin remains on a red 3 day Predator candle at the moment so caution is implied.

I commented that I would not include Macro / GeoPolitical stuff, but it is important to remember that there are heightened potential for escalation in global conflict, inflation, and Political chaos in the US. While these have all proven to be a temporary headwind for Bitocin in the past, it has not impacted the general trajectory for Bitcoin, but can present some great opportunities through volatility. Therefore be prepared for a wide range of potential outcomes in terms of volatility through 2024.

I would also like to invite you to a 14 day free trial of our Predator subscription package, which includes access to ongoing livestreams, analysis Decentrader dashboards and scanners and of course the Predator indicator and toolkit.

Click here to start your free trial

Onward and upward!

Best, filbfilb.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.