Bitcoin to range while $ETH and alts shine

Headlines

- After the weekend ‘crash’, Bitcoin looks to be bottoming with strong on-chain support.

- $BTC likely to range in the $50-$60k area in the coming weeks.

- Allowing money to flow into $ETH and altcoins.

- Bitcoin dominance to continue to drop vs. other cryptos.

Over the weekend the market experienced a sharp retrace as traders who were over-leveraged expecting more upside got punished.

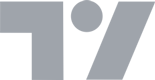

Coming out of that correction funding rates have now completely reset to neutral levels after flashing negative. What this means is that many greedy leverage traders got wiped out and are now scared to rush back into the market.

This is good for long-term investors and less greedy traders, as it means that price has reset and can start to move back up in a more sustainable manner.

Fig 1: Green bars show funding rates resetting back to low levels after the price correction. This is good for higher time frame price stability.

Pi Cycle top coincidence?

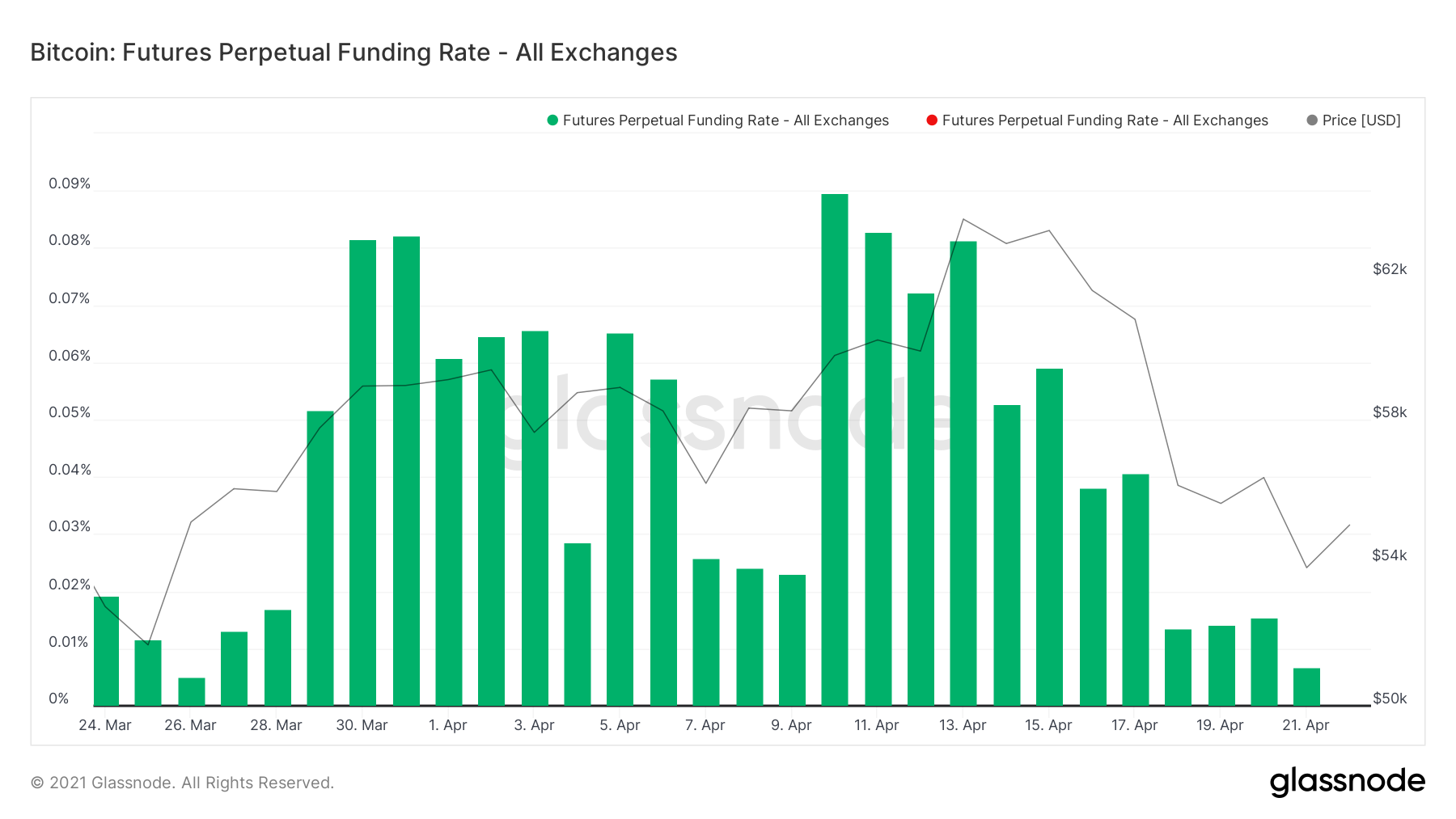

It is interesting to note that the market topped out one day after the Pi Cycle indicator triggered. Though as I outlined in my previous note, I still don’t believe we are about to enter a bear market. What I think is more likely is that we had this correction and $BTC price now ranges for a while before resuming upwards.

Figure 2: Pi Cycle triggered last week, the day before price topped out…but I don’t think we are entering a bear market.

On-chain data suggests we have not ended the bull run yet

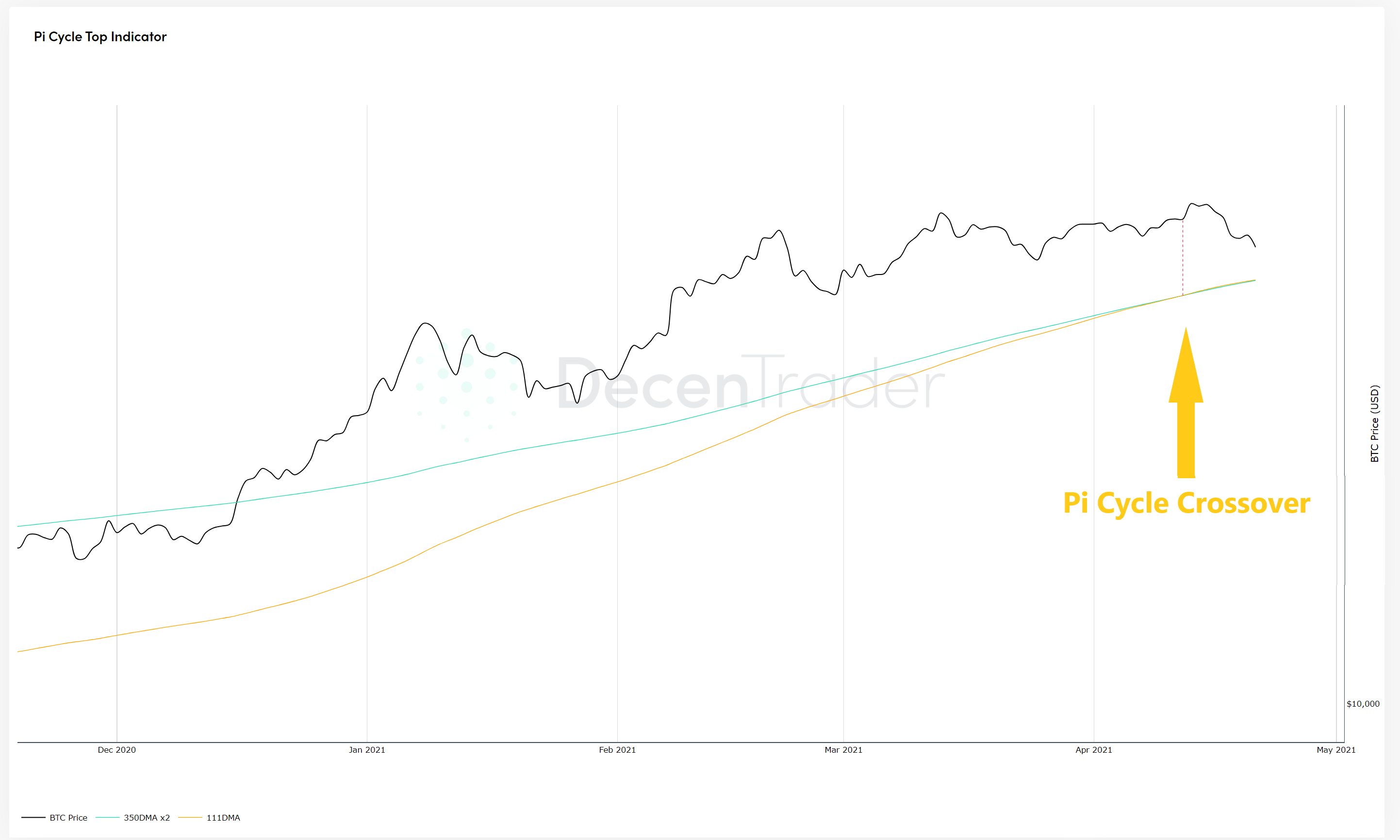

Although the Pi Cycle indicator crossed, no other indicators suggest we have reached peak market euphoria. In fact, due to $BTC ranging already for a couple of months now, indicators such as MVRV Z-score continue to retrace to very sustainable levels.

Figure 3: MVRV Z-score has reset to 4.0

This indicator gauges market euphoria by looking at the difference between current market prices and prices historically paid for bitcoin on-chain. When it hits a score above 7.5 (bottom of the red zone) then it shows the market is euphoric. This has correctly signaled the major previous cycle highs for Bitcoin.

Right now the score is dropping down to 4.0, which suggests that when the price does turn around it can still go A LOT higher before topping out.

Approaching a ‘buy the dip’ opportunity

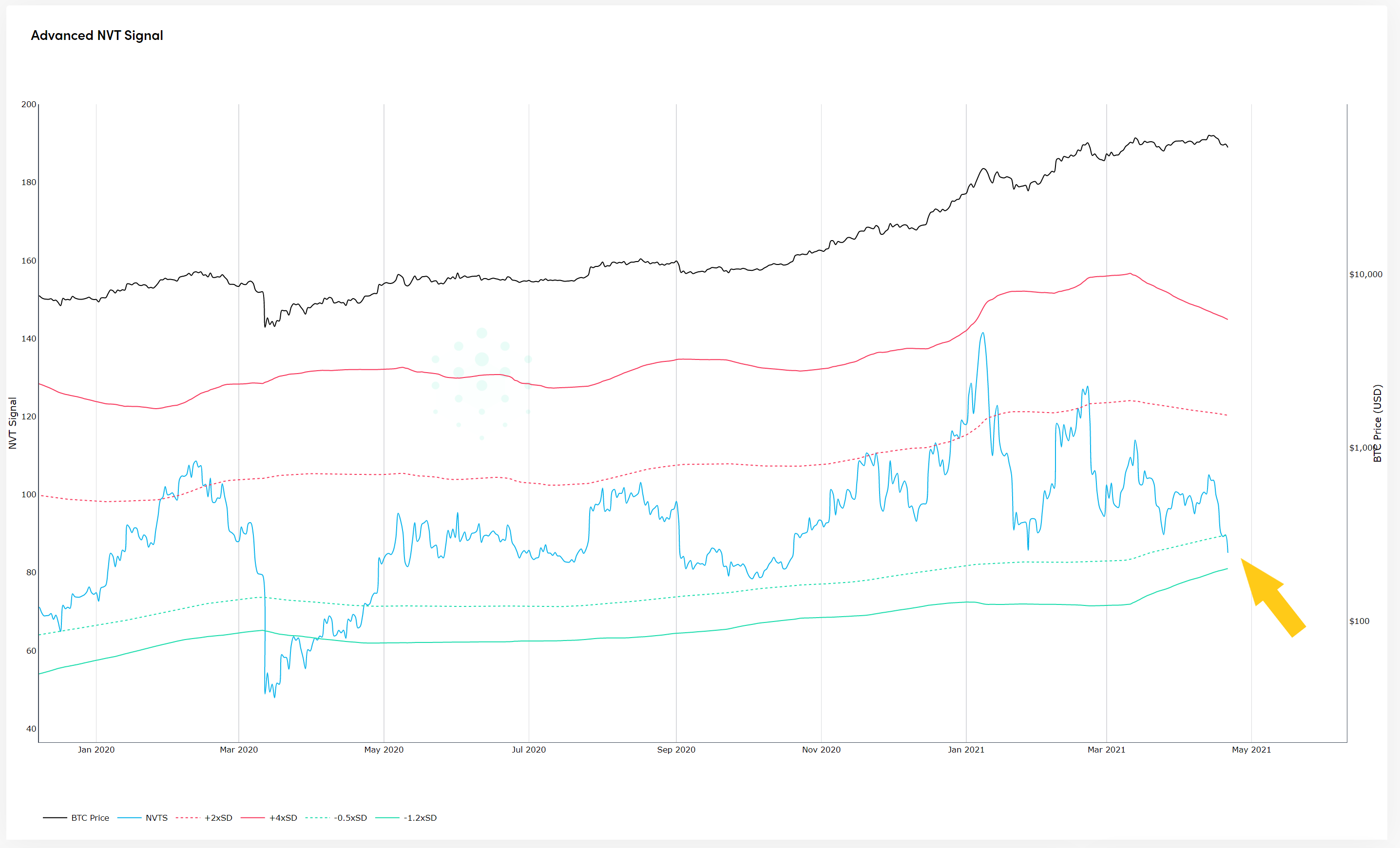

Advanced NVT signal looks at the relative differences between price and on-chain transaction volumes.

When the price is low relative to on-chain activity, the indicator (blue line on the chart below) enters the green band. This indicates that Bitcoin is relatively undervalued and presents a ‘buy the dip’ opportunity.

The indicator has not been in the green zone since the March 2020 Covid crash…until now:

Figure 4: Indicator has just entered the green value zone suggesting a buy the dip opportunity on medium-term time frames.

I have also observed on the blockchain a lot of on-chain buying volume around $47-49K, which I expect to act as very strong support should we even get down to those price levels.

In addition, we are continuing to see big increases in the number of users on the Bitcoin blockchain, which is also bullish.

So, while there has been a lot of fear on social media this week, I do not believe that there is a need to panic or be overly concerned about the price of Bitcoin right now.

Bitcoin versus other cryptos

However, I do believe that if $BTC ranges for the coming weeks then we will see other cryptos, notably $ETH, and potentially DeFi outperforms Bitcoin.

The chart below looks at the dominance of Bitcoin relative to other cryptos. There are issues with using this chart such as the fact that it includes new projects entering the market and stable coins. But it is useful as a broad gauge of where money is flowing.

You can see that since breaking out of the huge triangle, dominance has been dropping but is now at a support level that I have had drawn on the chart for some time.

Given the influx of new money entering the market and new entrants perceiving Bitcoin as “too expensive,” I am expecting money to flow into altcoins. That would cause Bitcoin dominance to drop for a period of time as certain alts outperform Bitcoin.

Figure 5: Bitcoin dominance has been dropping but is currently at a support level.

One potential caveat to this is if we hear soon that the likes of Apple or Facebook announce they are putting bitcoin on their balance sheets. This would cause a knee-jerk positive reaction in the price of Bitcoin.

Ethereum

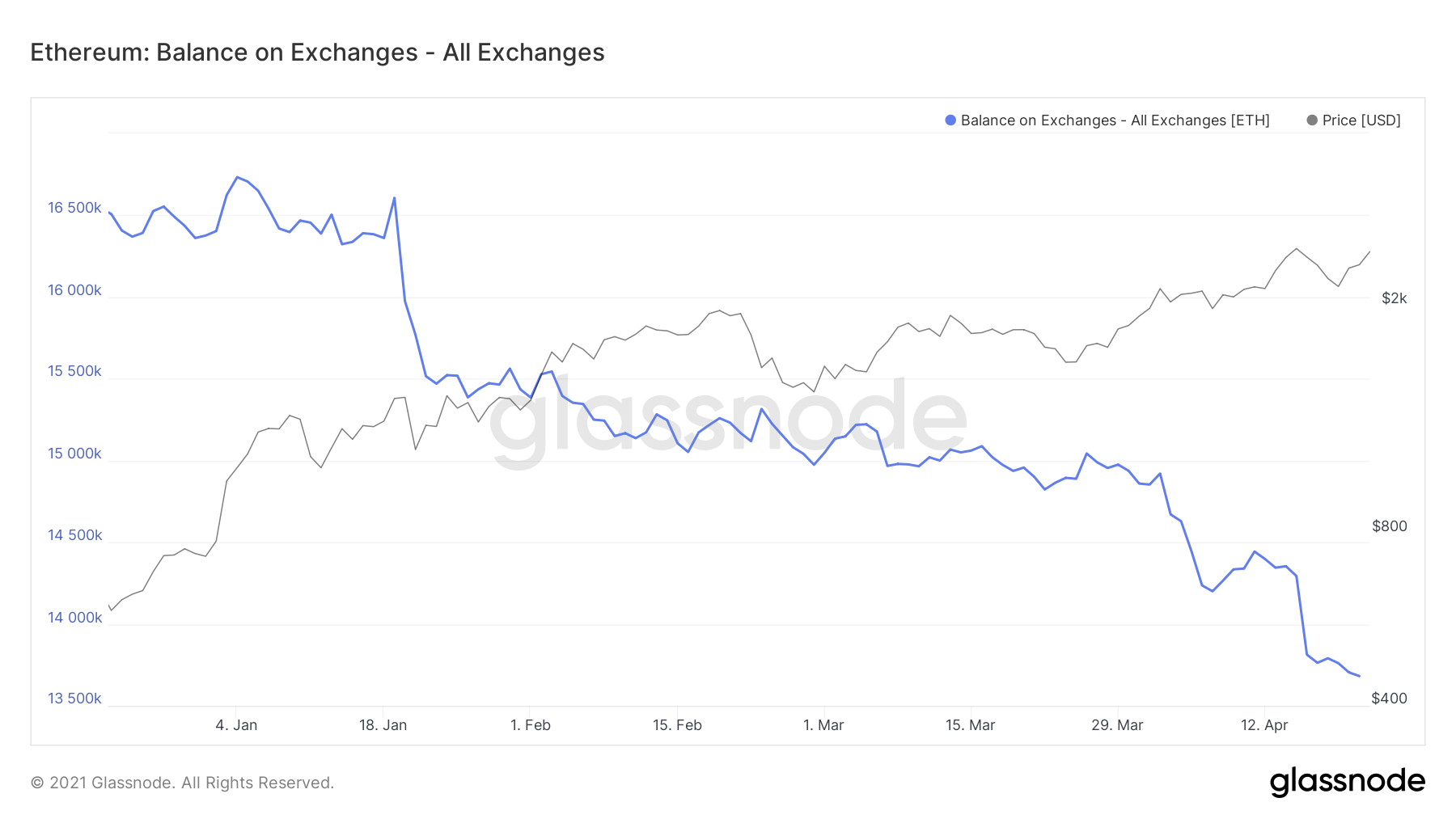

$ETH continues to look particularly bullish. One of the key reasons why I believe it looks so strong, beyond the fundamental news such as EIPP-1559, is the evidence of $ETH being taken off exchanges. We can see on the chart below how this draining of $ETH on exchanges has accelerated again in recent weeks:

Figure 6: $ETH held on exchanges (blue line) is rapidly decreasing.

This is very bullish for $ETH as it indicates that it is either being held in cold storage or being put to use in DeFi. Both of these factors reduce the short-term supply available to be sold on the market…as demand increases, the restricted supply results in price going up.

So we are likely entering a period in the market now where Ethereum and certain alts outperform Bitcoin.

Zooming out and looking at the total crypto market, I continue to think that there is still a lot more upside to come in this bull run as we head further into 2021, and the recent pullback we saw at the weekend is now largely over.

Thanks and speak again soon.

Philip

Want to learn more? Click here to subscribe!

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.