Ethereum Merge

*We’re running a massive 30% Merge Madness discount so you can stock up on munitions of meaningful metrics and musings of market masters Filbfilb and PositiveCrypto. The discount will be active until the Merge takes place! Just use code “mergemadness” when you checkout*

ETH merge – what you need to know

With the Ethereum Merge predicted to happen next week (approx Wed Sep 14th at time of writing), we wanted to run through the essentials of the Merge. There are a lot of moving parts, so we have summarised some of the concepts and what it means from a fundamental point of view in this short article.

No more work

The primary change is the shift from Proof-of-Work (PoW) to Proof-of-Stake (PoS). At the same time, the issuance of new Ether will be reduced dramatically from approx. 13,000 per day to 1,600 per day, equal to a roughly 90% reduction. Further, there is no requirement from miners to sell Ether to pay for mining hardware and operating costs. This will theoretically result in up to a 100% decrease in selling pressure from new Ether issuance. At current prices this would equate to $7.8 billion less selling pressure per year. Whilst this is a maximum, even a percentage of this amount will equate to a significant reduction in selling pressure.

Upgrades

Once the Merge is live, 6-12 months later the Shanghai Upgrade will commence. This is where we will see reduction in gas fees, improvements in scalability, as well as staked Ether on the Beacon chain will be unlocked. This will be a double edged sword as the upgrades could make Ethereum deflationary, however some Ether will have been staked since the Beacon chain launch, Dec 2020, and could represent a large amount of sell pressure. There is currently 14,320,814 ETH staked, equal to $23.6 billion. It is very unlikely this will all instantly be sold, but we could see increased sell pressure.

Staking

The full force of sell pressure is unlikely to be unleashed, due to the existence of Liquid Staking Protocols. These offer a synthetic derivative of ETH that is issued 1:1 with the amount of ETH staked. This allows for the user to receive ETH staking rewards whilst also implementing DeFi strategies on their staked ETH token, essentially doubling yield. These Liquid Staking tokens represent approximately a third of all staked ETH, with Lido Finance’s stETH being the largest. Rocket Pool’s rETH and StakeWise sETH2 are other promising projects.

Whilst these tokens will eventually be redeemable 1:1 for ETH, most are not trading at parity – thus offering a potential arbitrage opportunity. Currently stETH is trading at 0.966 ETH, effectively trading 3.4% below the price of ETH. It is likely volatility increases around the Merge and there could be many opportunities like this appear.

Potential for a fork

Another potential opportunity will arise from any forks that remain on Proof-of-Work, as has been discussed in the community. Recently, this seems to have lost steam especially as both Tether ($USDT) and Circle ($USDC) have said their Stablecoins will not be redeemable from the fork. Remember, any fork of ETH will include forking every token, NFT and stablecoin built on the Ethereum network. $USDT and $USDC represent $120 bil alone, and this being worth nothing will likely make many ETH fork projects implode.

Regardless, speculation is probable around the Merge and we often see forks pump initially. Poloniex, BitMex, MEXC and BitFinex all have futures contracts for a ETH Proof-of-Work fork. Trading these are a bit beyond our risk appetite, but they remain useful proxies for the market predicting the likelihood of success for any ETHPoW fork.

Action by the exchanges

If you are looking to trade any forked tokens, you will want your ETH on-chain in a self custody wallet. Exchanges have announced different plans for what to do in the eventuality of an ETH fork and most are taking a retrospective approach – read Binance, FTX, Coinbase for their respective approaches. Most will pause deposits and withdrawals during the Merge.

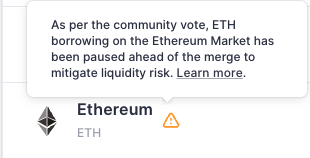

Another fork proxy will be the fees for borrowing ETH via DeFi protocols. The Aave community voted to pause ETH borrowing, but borrowing is still possible on Compound. If fees skyrocket, this is because traders are seeking to hold as much ETH as possible to receive as many fork tokens as possible.

Of course there remains a proven Ethereum fork – Ethereum Classic. This will remain on a PoW consensys mechanism. In the run up to the Merge, the Ethereum Classic hashrate has rocketed to new all-time highs and price has responded positively even in recent market conditions.

Currently $ETH looks stronger than $ETC on Predator across time frames, using our Predator Thermal Scanner.

![]()

![]()

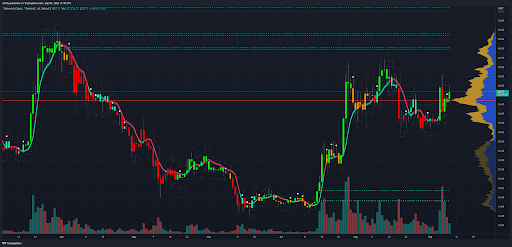

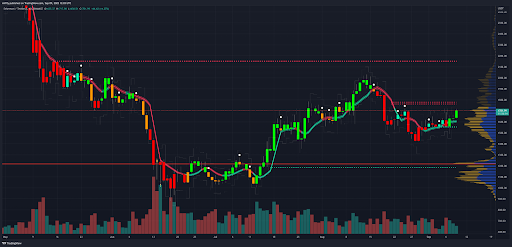

However, we’ve seen more explosive moves with $ETC than $ETH lately so it remains worth paying attention to. Currently, it is sitting above the POC, the Mean Reversion line and is relatively bullish on HTF. Looking at ETCUSDT a move up to the Moonraker resistance levels around $47-$51 seems likely, if Ethereum Classic is able to capture a decent portion of Ethereum miners and we see a continued hashrate increase.

ETCUSDT 1 Day chart

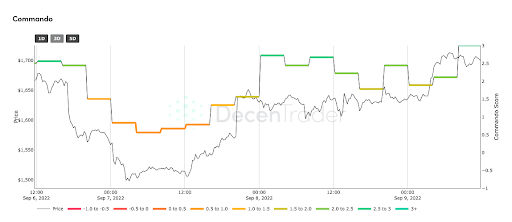

Lastly, if you believe in Ethereum, then Ethereum improving and evolving strengthens the bull case and makes $ETH the place to trade. Since printing 2.72 on Commando , we’ve seen $ETH rally 5%. It now scores at 3 which can be a sign the move is reaching its climax in the short term.

A quick look at the ETHUSDT chart shows promise as well. Provided the bulls can clear the resistance between $1750-$1800, the Merge could catalyze a move towards $2200.

ETHUSDT 1 Day chart

Risk

It is important to remember that there are multiple potential headwinds that could turn things in favour of the bears, namely bugs in the Merge code, a significant proportion of the Ethereum network moving to a fork taking market value with it, as well as Macro headwinds from the US August CPI data next week.

It’s also important to remember that overall, there remains macro and geopolitical systematic risk which might halt the most bullish narrative for ETH. Lets see if price can hold, post merge..

Long term, the Merge has fundamental changes which we are interpreting as being bullish for Ethereum, but the actual event will undoubtedly prove to be volatile as the market wrestles between narratives. Be extremely wary of scams, fork tokens etc, we have already seen multiple around the Merge and ETHPoW forks.

To stay tuned with current analysis around the Merge, become a DecenTrader member where you can also access the tools and indicators included in this article for a limited time use code “mergemadness” when you checkout*

– Miffy

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.