Market Update by Philip Swift – 15.10.20 – Bounce or Die for Alts?

Hi everyone,

It has been a tricky couple of days for Bitcoin after a solid bullish run up last week. We discussed in the Decentrader livestream on Monday how Bitcoin may need to take a little breather on its run up and that is exactly what we have seen happen this week.

From a technical analysis perspective, we can see that Bitcoin reached both the top of the channel it had been climbing and also resistance at the 0.786 key fib retracement level.

Figure 1: $BTC price rejected off the top of the channel and 0.786 fib level.

Since then price has been pulling back. Funding is currently neutral so not offering too many clues as to where we may go next.

On-chain

While on-chain data is still bullish on macro timescales, in the near term there has been a signal indicating that price may need to cool off for a period.

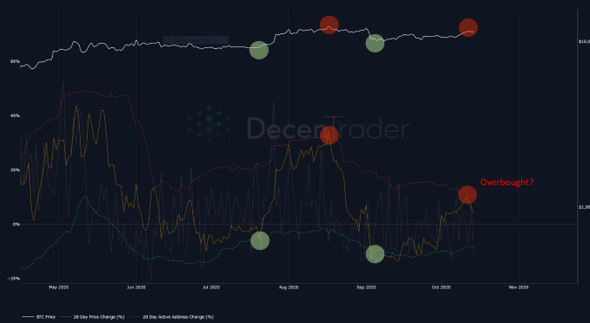

Active Address Sentiment Indicator compares growth in price change with growth in active addresses. It was remarkably close to overbought levels two days ago. This occurs when price changes (orange line) outpace active address changes and hit the upper boundary (red dotted line) of address changes.

Figure 2: Active address sentiment indicator.

This has historically been a good indication of the market being overheated in the near term, and a potential need for price to pullback which we are seeing now.

A continuation would see the indicator move back towards the lower green boundary signalling that $BTC is oversold in the short term and ready to bounce.

From a technical analysis perspective, such a continuation could see $BTC pullback to the bottom of the channel at around $10,800, and towards the 128 day moving average which has been excellent support in recent weeks.

Figure 3: $BTC further sell off could see a move back to the bottom of the channel.

Given the very bullish macro backdrop right now, I would not expect $BTC to spend much time below these levels, if at all, should we continue down in the coming days.

However, such a move could be painful for alts in the short term, most of which have been selling off this week versus $BTC as Bitcoin pulls back. When Bitcoin bleeds, alts bleed more.

A noteworthy example right now is good old Dogecoin (DOGE). It has held up for months, presumably as bagholders refuse to sell. But in this recent Bitcoin sell off we have seen DOGE drop down to 22 sats. Is this just a short term wick down or the start of something bigger? I suspect if Bitcoin continues to bleed we could see DOGE drop down into the 15-18 sats area which is 20-30% lower from here and would present a strong buying opportunity – not only for DOGE but for many alts across the board.

Figure 4: DOGEBTC: looks like many altbtc pairs right now. They either need to bounce fast or face a big drop down.

So we should have an interesting week or two ahead of us with the crypto market potentially on the brink of a big move. Stay safe and happy trading.

Cheers,

Philip Swift

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.