NFTs driving the market forward

While uncertainty around crypto continues, there is one sector that has been able to distance itself somewhat from many of the industry problems like exchange blowups and lending platform scandals. That sector is NFTs.

NFTs are sufficiently differentiated from the rest of the market, and to a large extent have their own ecosystem. For this reason, the NFT sector is heating up and rebounding from lows a lot faster than much of crypto.

Let’s take a look at this emerging trend and also which collections may be on the move next.

Blue Chip NFTs outperform ETH

Simply holding large-cap NFTs over the past six weeks has allowed NFT investors to significantly outperform Ethereum.

The NFT low versus Ethereum came in mid-November when broader crypto market fears forced many to capitulate on quality NFT projects.

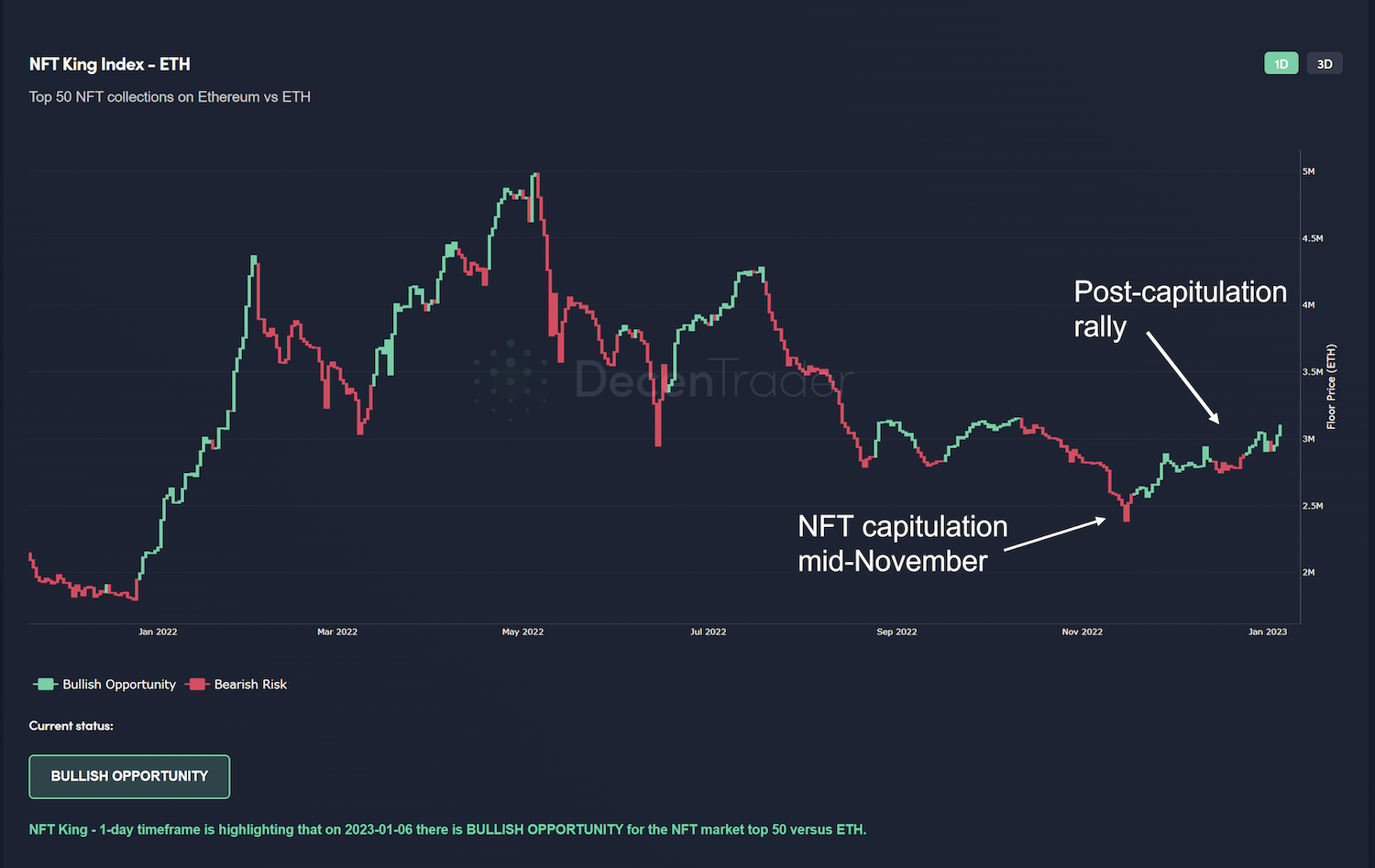

This is shown by the DecenTrader NFT King Index which tracks the floor prices of the top 50 NFTs on Ethereum:

Figure 1: The NFT King Index shows the strong rally for the Top 50 NFTs vs. ETH.

Figure 1: The NFT King Index shows the strong rally for the Top 50 NFTs vs. ETH.

Unless there is a broader market crash, this trend has a good chance of continuing as confidence comes back into the market.

For now, NFT King Index indicates continued bullish opportunities for NFTs. Historically it has been accurate in terms of indicating when top NFTs are able to outperform Ethereum. See the green (bullish) and red (bearish) candles on figure 1 which have successfully avoided the major drawdowns over time.

NFT King Index is a free tool with no sign-up required. You can use it HERE.

Which collections are leading the way?

The rally has so far been led by some of the more well-known collections in the space. What some may call ‘blue chips’.

Pudgy Penguins has continued to make new ATHs in recent weeks and its floor price is currently holding above 7 ETH, up +200% from its lows just 6 weeks ago.

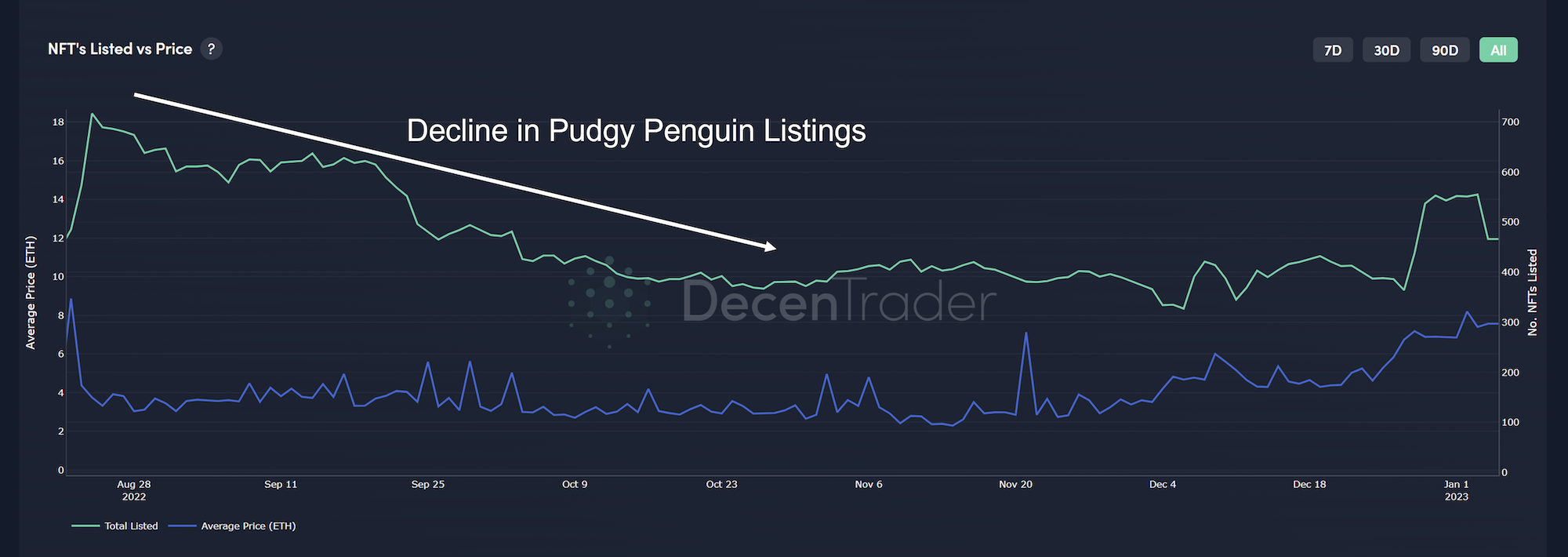

While the NFT market was generally depressed going into Q4 2022, the number of Pudgy Penguins listed on exchanges continued to decrease – an indication that available supply was drying up as long term holders were not prepared to sell at low prices:

Figure 2: The number of Pudgy Penguin NFTs available for sale dried up.

Figure 2: The number of Pudgy Penguin NFTs available for sale dried up.

This meant that when demand started to kick back in there was a relative shortage of supply which helped to accelerate price up further, with the floor price being swept multiple times.

In such circumstances, listings then typically increase again once price starts accelerating as some holders look to list their NFT’s to sell and realize profits. Though it is noteworthy that there has been a sharp drop in listings again the past few days.

NFT King continues to be bullish across both the 1-day and 3-day timeframes for now even as the floor price consolidates around 7 ETH:

1-Day:

Figure 3: NFT King bullish for Pudgy Penguins on 1-day timeframe.

3-Day:

Figure 4: NFT King is also bullish for Pudgy Penguins on 3-day timeframe which is used for longer-term trends.

Other ‘blue-chip’ collections such as Azuki and Bored Ape Yacht Club have also been leading the rally since November. Azuki floor price is up +90%, and BAYC up +60% from the lows.

What Happens Next?

Whether this trend can continue depends a lot on whether crypto generally can maintain current prices in the near term. Should there be another shock to the system that sends Bitcoin and Ethereum tumbling then a race for liquidity would put an end to this NFT rally.

But as long as Bitcoin and Ethereum hold their levels, or potentially go on a relief rally of their own, then that increases the probability of this NFT trend continuing.

The NFT King Dashboard is a useful market-trend check as every 24hrs it shows which collections have turned bearish and which have turned bullish on either the 1-day or 3-day timeframe.

Right now there are 7 collections that have turned bullish and just 1 that has turned bearish, which gives an indication of trend direction in the NFT market right now:

Figure 5: New bullish movers on the NFT King dashboards.

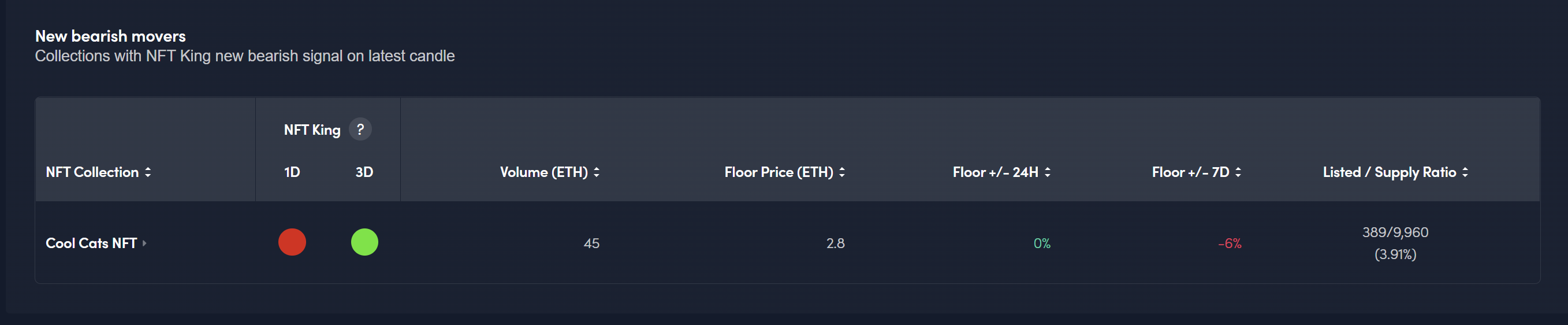

Cool Cats is the only Top 50 NFT collection to turn bearish on either timeframe:

Figure 6: Only one collection has turned bearish on NFT King in the past 24hrs.

The OG collection of Cryptopunks looks like it may be ready to finally break out of the tight range it has been operating in over the past 4 months after a run to the downside and now turning green on NFT King:

Figure 7: Cryptopunks turning bullish on NFT King

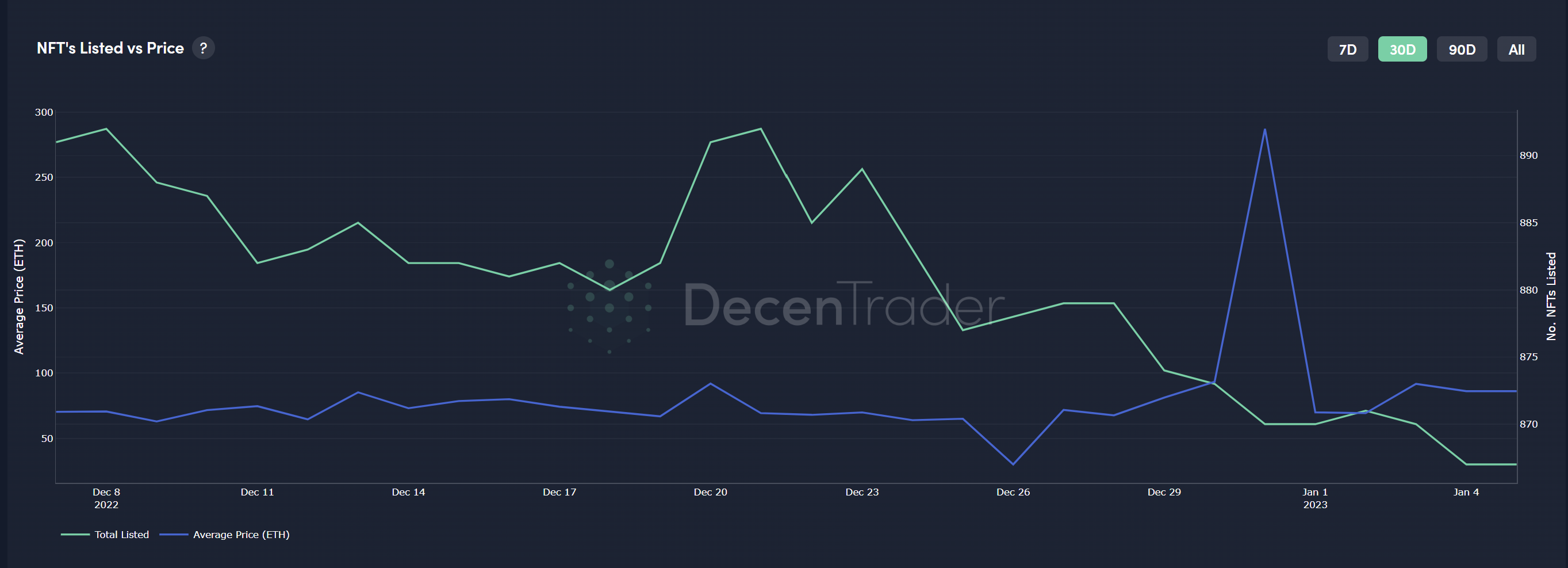

The number of punks listed for sale (green line on the chart below) has been dropping significantly the past month which is notable as price starts to break out:

Figure 8: Number of Cryptopunks available to buy has been dropping the past 30 days.

We are now also starting to see smaller cap collections turn bullish, such as ASM Brains which is ranging between 0.5 ETH and 1ETH:

Figure 9: ASM Brains bullish and bouncing from the bottom of the range.

Concluding thoughts

There is clearly strong momentum in the NFT sector right now. Whether that can continue will very much depend on whether Bitcoin and Ethereum can hold up in terms of price as we move into Q1. As long as they do then there will be plenty of opportunities for NFT’s to outperform ETH in this current market environment.

Should the trend start to dry out across collections, we will likely see it first when NFT King turns bearish.

Speak again soon,

The DecenTrader Team.

– Article by PositiveCrypto

Click here for your 7-day free trial of NFT King and all other DecenTrader dashboards and tools.

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.