SEC Crypto Crackdown

A lot has been going on this week regarding SEC crackdowns, so here is the simple version. If you’d like to get some more detail we have broken down these further in the included links:

– Binance got served by the SEC.

– Coinbase received a similar but less ‘illegal’ lawsuit (no commingling of funds, no unregistered security exchange token) the next day.

– 11 States also filed against Coinbase, claiming staking was a securities contract.

– Last year, Coinbase petitioned the SEC for rule clarity. As the SEC had still not responded but decided to file suit against Coinbase, the Third Circuit court intervened and has given the SEC a week to respond as if they are charging Coinbase with rule breaking, they must have decided what the rules are.

Ahead of the announcement, we could see that Bitcoin was already starting to weaken, with momentum showing to the downside and Predator red on the hourly timeframe. At the bottom, we could see that momentum was shifting to the upside, with a bullish divergence on the Predator Momentum Oscillator and Predator confirmed this by turning green on the hourly.

BTCUSDT on the hourly timeframe with the Predator indicator overlay and Predator Momentum Oscillator

The Predator indicator, which includes the DecenTrader toolkit, is now available on a monthly plan at just $129/pm. You can purchase it here.

Limited time special offer for market update readers. Enter this code at checkout and you will get 33% off for the first month (pay just $87!) on the new Predator monthly plan:

predator33

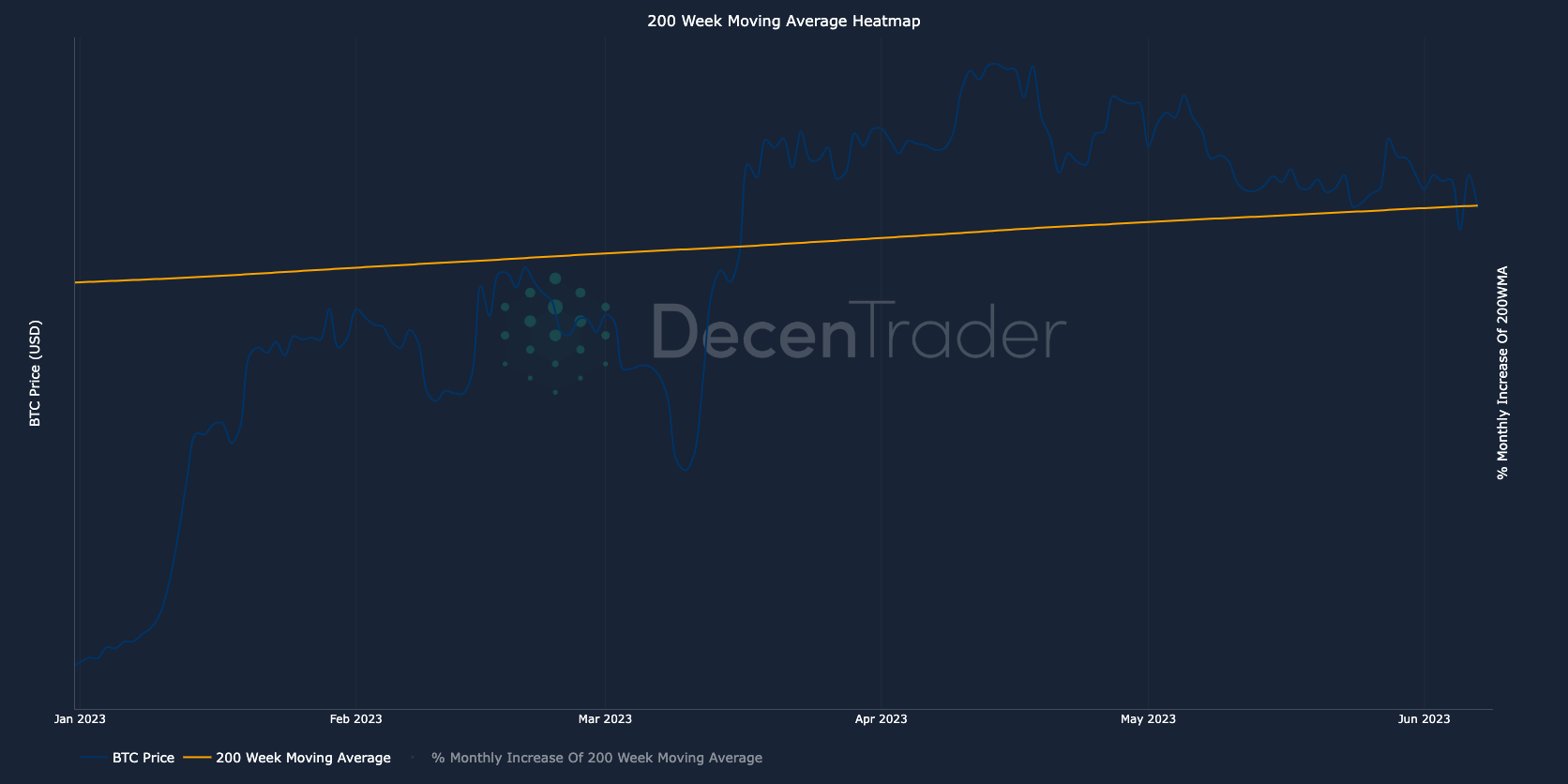

Bitcoin then managed to run up to the Moonraker resistance at $27,300, before pulling back. Currently the market is choppy, just above the 200 Week Moving Average, which typically acts as strong support and resistance.

The 200 week moving average for Bitcoin

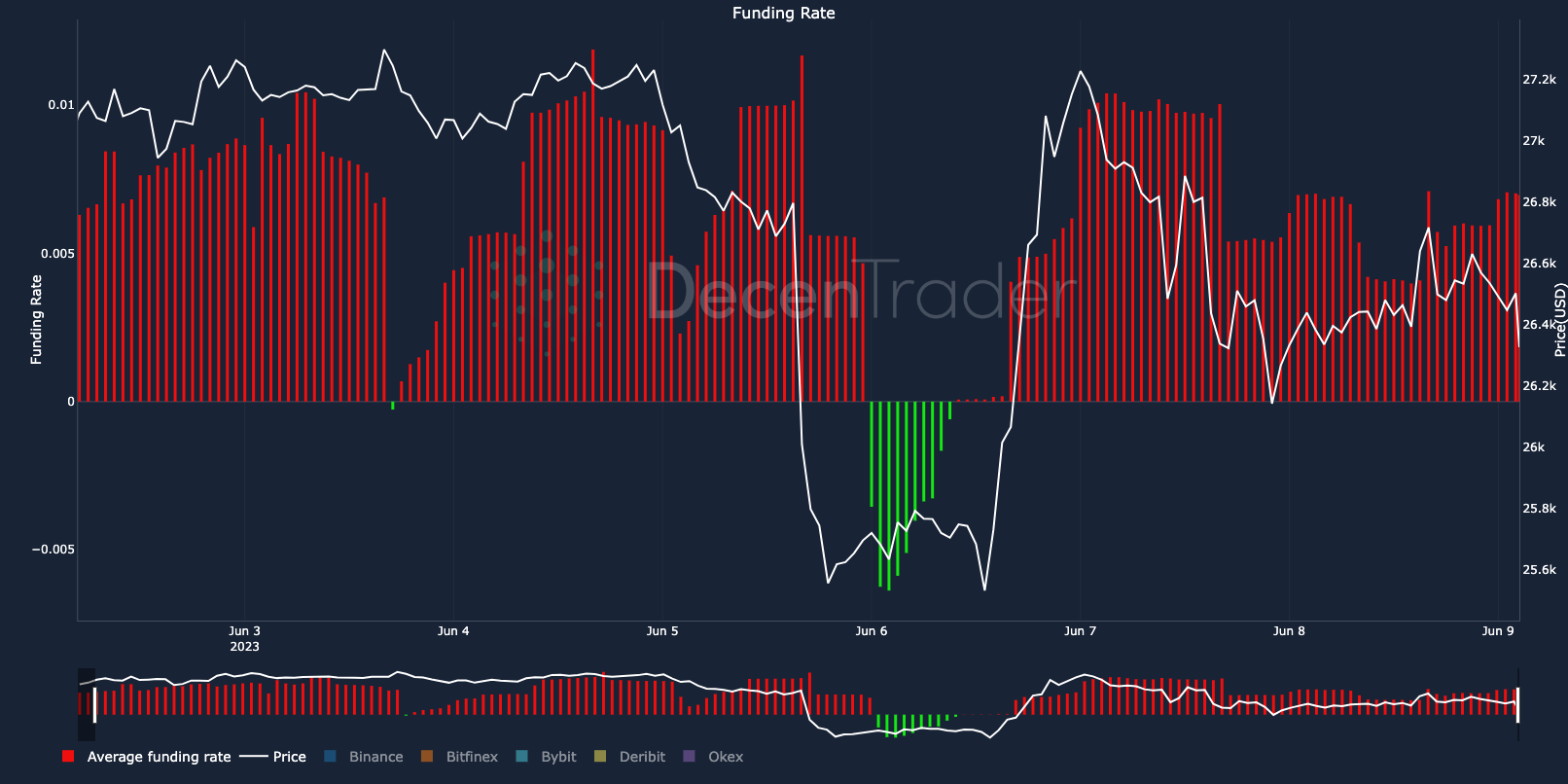

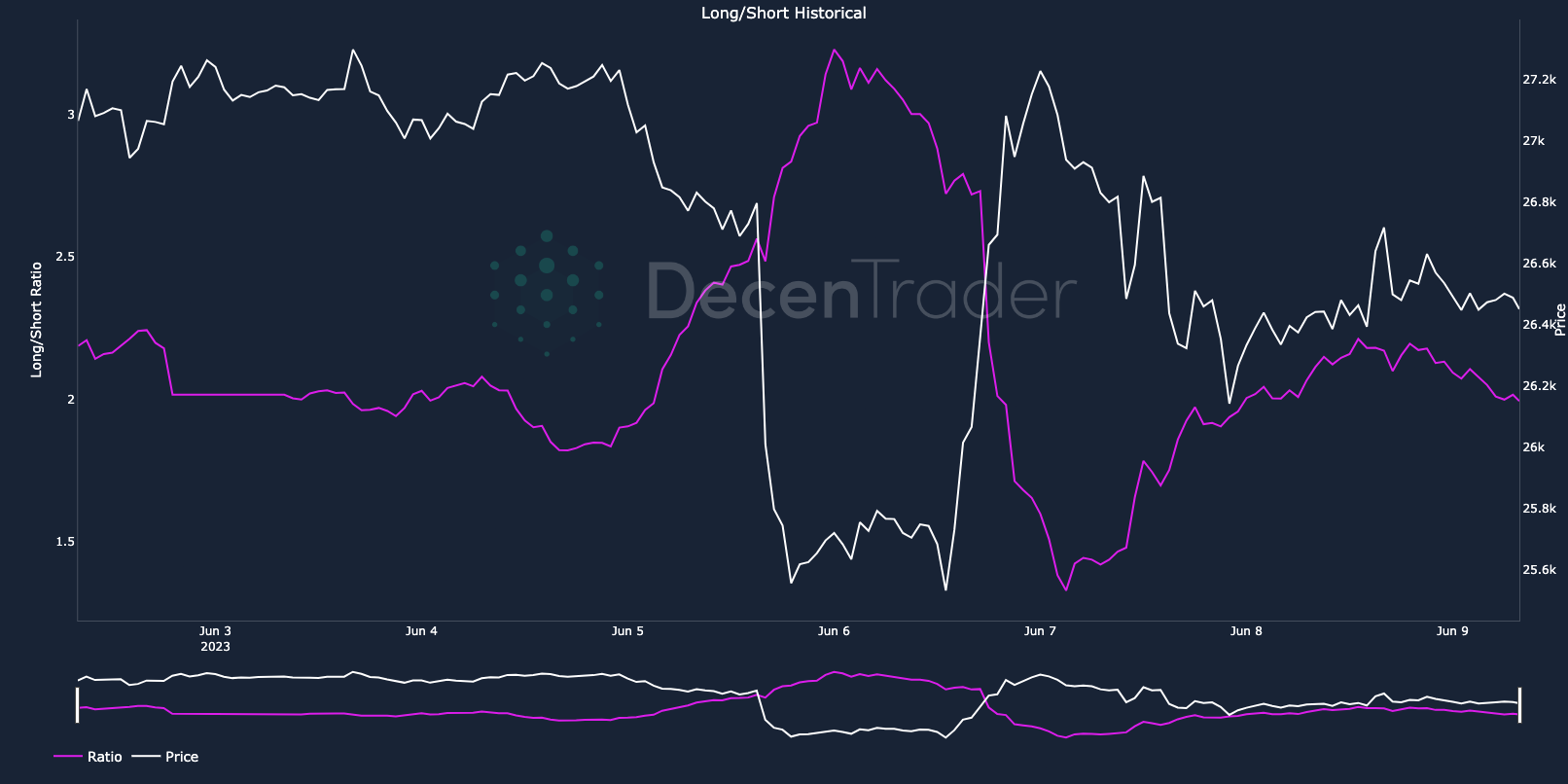

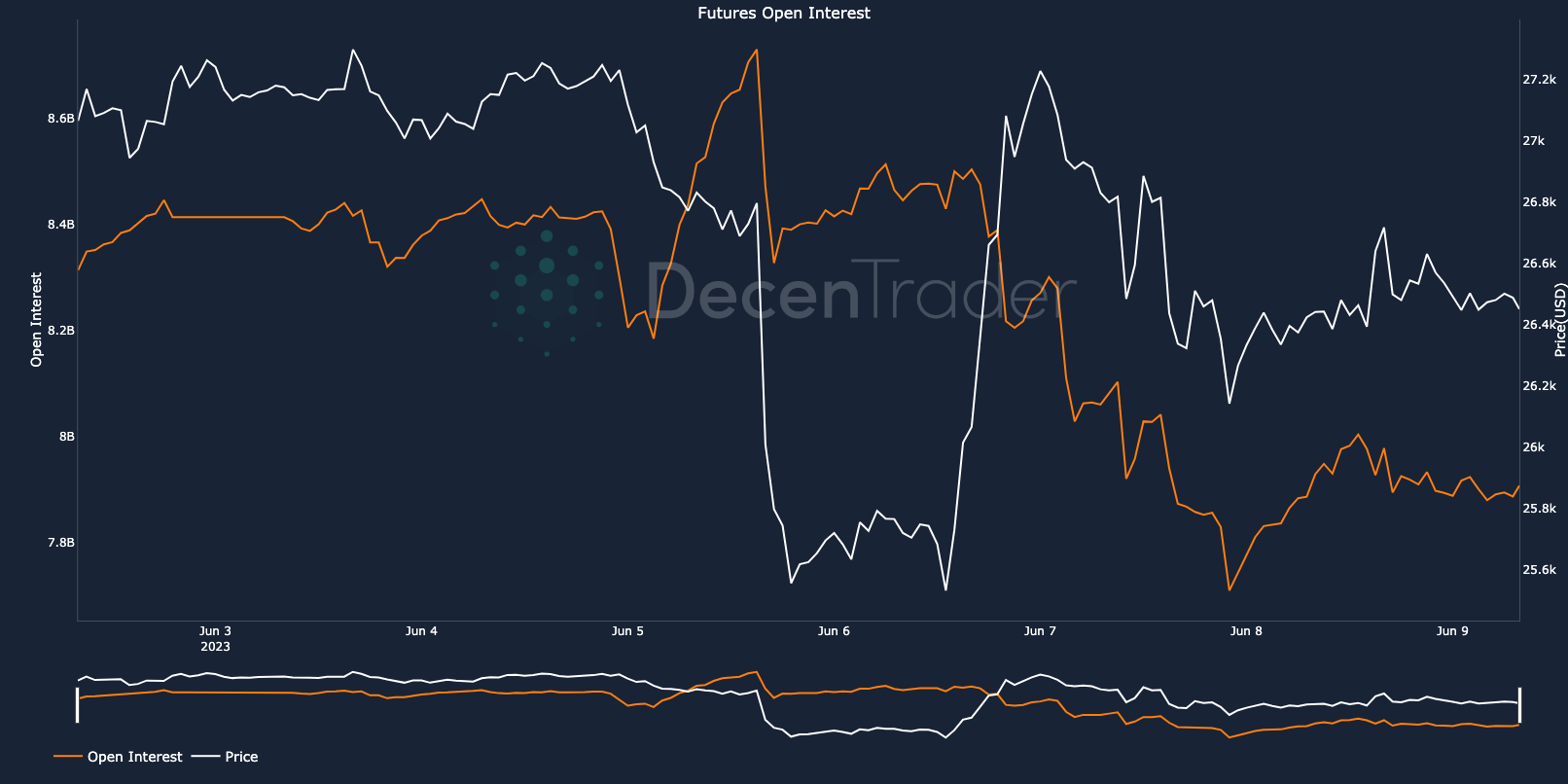

Although the crypto market dumped broadly, conditions were deteriorating prior to the lawsuit announcements. We saw a heightened funding rate, a climbing long short ratio and a significant increase in open interest. Traders were overexposed to the long side, which contributed to the drop as we saw large liquidations.

Funding rates increasing prior to move down. Funding rates turned negative at peak fear, signaling a trend direction was potentially ahead.

The Long/Short ratio was increasing ahead of the move and continued as trades longed the dip. It wasn’t until this turned around that the market was able to properly bounce.

Open Interest increased ahead of the move, providing lots of fuel for liquidations. After both longs and shorts were flushed out, open interest has been subdued.

Key Dates:

We have a confluence of key events happening next week that will likely bring about increased volatility to the markets again.

June 13th:

– Binance TRO hearing (Restriction on assets for Binance.US)

– Congressional Hearing on Crypto Regulation

– Release of the Hinman documents in the Ripple Case

– Deadline for the SEC to respond to the 3rd District Court regarding Coinbase’s previous requests for rule clarification

– CPI data release for May

14th:

– FOMC decision

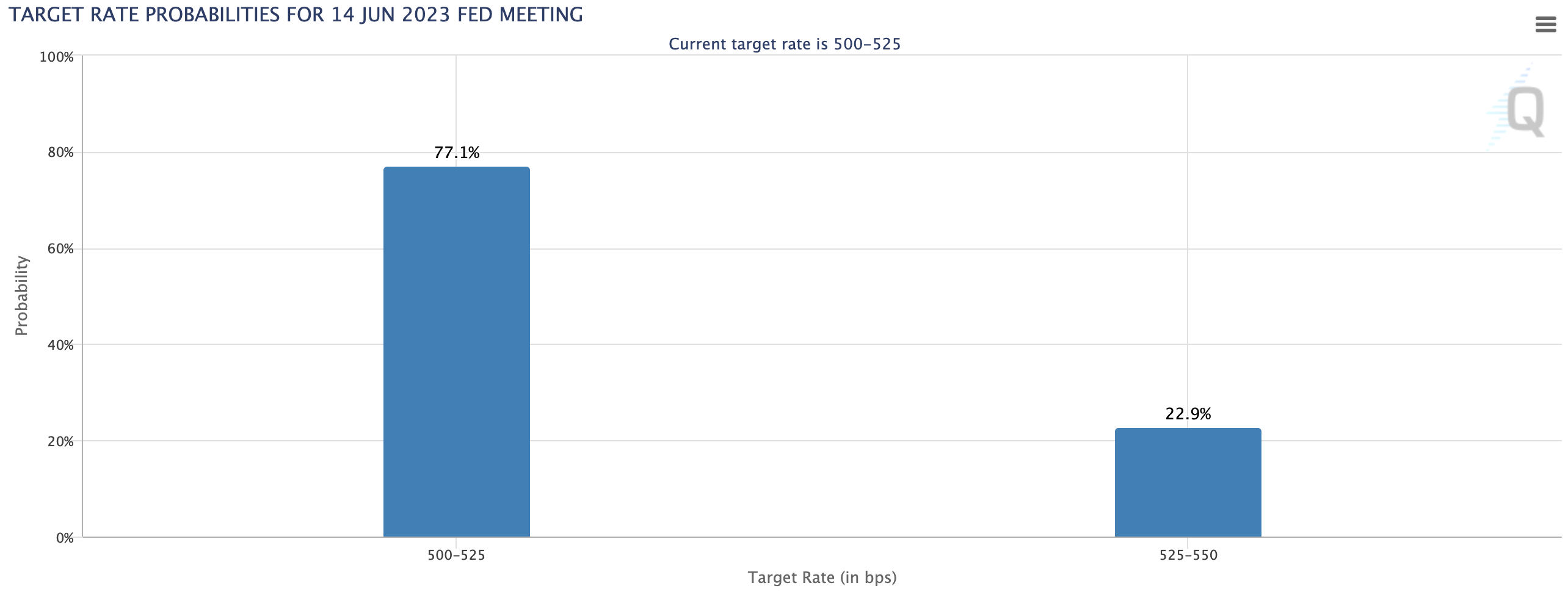

Markets are currently predicting a 77% probability that the FED will not raise rates at their next meeting, which would likely be bullish for risk on assets like Crypto.

Reasons to be optimistic:

Whilst the news out of the US has been decisively bearish this week, zooming out for the big picture shows there have been multiple bullish announcements for the long term growth of the industry.

– Next week we have a US congress hearing regarding a bill put forward by pro-crypto candidates. This is more inline with CFTC guidance which would treat a majority of assets as commodities as well as a potential framework for a new asset class with clear rules.

– Large funds like Franklin Templeton ($1.3 trillion AUM) have expressed their interest recently, and the Soros Fund (started by billionaire trader George Soros) stated that they think recent SEC setbacks could provide an excellent opportunity for traditional finance firms to enter the market.

– One example of this could be that NASDAQ is to offer crypto custody services by the end of June. The NASDAQ is a registered securities exchange, so this could provide a much needed on-ramp for US institutions, something that has generally been missing since the collapse of SVB and Silvergate.

– Whilst US regulators don’t seem to be in a hurry to support the crypto industry, the UK government released their report on how they can make the UK a leader in crypto in the next 12-18 months. This comes a week after Hong Kong opened trading for retail crypto customers and a month after the European Union announced their MICA regulations regarding crypto.

-Tether, the issuer of USDT, has announced their intentions to use up to 15% of net profits each month to purchase Bitcoin. Recently, the largest stablecoin reached a new all-time high market capitalisation and is expected to make in excess of $2 billion in profits this year, due to the high yield on the bonds they hold.

If you want to know our thoughts on what could happen if Bitcoin breaks above $30k, be sure to check out our previous market update available here.

Predator for a month for just $87!!! Get 33% off your 1st month when you purchase the Predator new monthly plan here. Enter this code at checkout: predator33

Disclaimer: Nothing within this article should be misconstrued as financial advice. The financial techniques described herein are for educational purposes only. Any financial positions you take on the market are at your own risk and own reward. If you need financial advice or further advice in general, it is recommended that you identify a relevantly qualified individual in your Jurisdiction who can advise you accordingly.